Access Real Value through

Fractionalised Investment Opportunities

Private Equity

Private Credit

Funds

Real Estate

ESG Impact

Alternatives

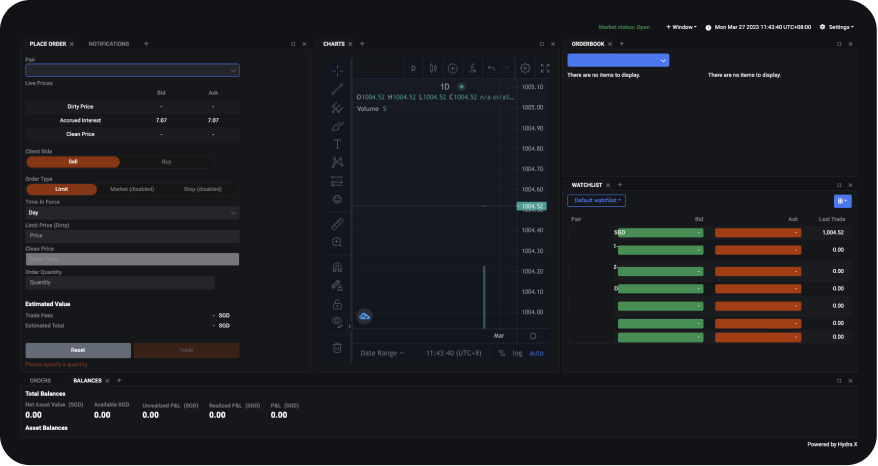

Trade on our Exchange

The SDAX Exchange platform can provide liquidity through buying and selling of digital assets.

Past Investments Showcase

CGS SG 3-month SGD Commercial Paper Series 008

- Singapore

- Array

About the Issuer CGS International Securities Singapore Pte. Ltd. (UEN: 198701621D) is licensed by the Monetary Authority of Singapore and is a wholly-owned subsidiary of CGS International Securities Pte. Ltd. […]

- Loan Quantum: SGD 5,930,000

- Tenor: 91 days

- Gross Returns (p.a.): 2.80%

- Minimum Investment: SGD 10,000

CGS SG 3-month USD Commercial Paper Series 008

- Singapore

- Array

About the Issuer CGS International Securities Singapore Pte. Ltd. (UEN: 198701621D) is licensed by the Monetary Authority of Singapore and is a wholly-owned subsidiary of CGS International Securities Pte. Ltd. […]

- Loan Quantum: USD 8,670,000

- Tenor: 91 days

- Gross Returns (p.a.): 4.80%

- Minimum Investment: USD 10,000

Intraco 1-month USD Commercial Paper Series 012

- Singapore

- Array

About the Issuer Intraco Limited (UEN: 196800526Z) (“Intraco”) was incorporated on 5 November 1968 and has been listed on the Mainboard of the Singapore Exchange since 18 December 1972. Intraco […]

- Loan Quantum: USD 5,400,000

- Tenor: 35 days

- Gross Returns (p.a.): 5.90%

- Minimum Investment: USD 10,000

Intraco 1-month SGD Commercial Paper Series 016

- Singapore

- Array

About the Issuer Intraco Limited (UEN: 196800526Z) (“Intraco”) was incorporated on 5 November 1968 and has been listed on the Mainboard of the Singapore Exchange since 18 December 1972. Intraco […]

- Loan Quantum: SGD 15,950,000

- Tenor: 35 days

- Gross Returns (p.a.): 3.90%

- Minimum Investment: SGD 10,000

Refine your search

Frequently Asked Questions

SDAX is a regulated investment and trading platform providing multi asset securities and fund units. We fractionalize and tokenize institutional-grade real assets for trading on our blockchain powered exchange. We democratize access into the universe of securities – private funds, private equity, private credit across different industries – for the benefit of a wider investor base.

Our ability to originate, structure and distribute investment opportunities across asset classes including securities, fund units and real estate allows us to unlock an end-to-end ecosystem spanning the primary and secondary markets.

SDAX is regulated by the Monetary Authority of Singapore (MAS) and has a Capital Markets Services (CMS) License and a Recognised Market Operator (RMO) License from MAS.

SDAX exchange is licensed by the Monetary Authority of Singapore (MAS) and one of the first Singapore-based exchange offering purely asset-backed digital securities.

We have a robust backing from a strong sponsor group including ARA Asset Management Limited/ESR Group, The Straits Trading Company Limited (STC), and PSA International.

Digital security tokens can be stocks, bonds, funds, and other financial securities that are digitized and recorded on blockchain. The creation of digital security tokens is through a process called “tokenisation” which is the representation of the ownership and related rights of stocks, bonds or financial securities on blockchain. The process of tokenisation does not create any new rights, but simply represents digitally, in an immutable and secure format, the ownership and related rights of the issued stock, bond, fund or financial securities instrument.

At SDAX, we understand the general concerns that investors have towards recent events in crypto, and would like to emphasise to and assure our clients and the community of the following:

- SDAX is not a cryptocurrency exchange. We do not list or trade any cryptocurrencies on the SDAX Exchange, and we are not financially exposed to the crypto markets whether in investment deals or financial asset holdings.

- SDAX only curates investment opportunities on its platform which are structured as securities or fund units, and are based on real assets with intrinsic value.

- SDAX is regulated by the Monetary of Authority of Singapore with Capital Markets Services (CMS) and Recognized Market Operator (RMO) licences. As a fully regulated entity and platform, we are subject to stringent regulatory oversight, including requirements on holding regulatory capital reserves in our accounts.

- SDAX’s accounts and financials are audited by KPMG.

- SDAX keeps all client funds and assets in separate custody accounts. Client funds and assets are at all times segregated and never co-mingled with SDAX’s capital reserves and operational accounts.

- SDAX’s current financial standing is stable and operating healthily.