The Skipping Fed

- Financial Insights

- Market Insights

- The Fed is likely to skip this meeting and leave a rate rise for July

- Central banks of Australia and Canada both surprise the market with a policy rate rise

- ECB expected to raise rates by 25bps with an outside chance of an adjustment of policy in Japan

- Japanese equites continued to be supported by domestic positives – this past week an upward revision to 1Q growth

- Caution warranted on high yield bonds with rising defaults

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The FOMC board members appear convinced about not increasing interest rates at this week’s meeting. Despite higher inflation, a tight labour market, and economic data evidencing stronger-than-expected growth, the Fed will in all likelihood maintain status quo at this week’s meeting. The central bank, though, may warn that an increase in rates in July is a strong possibility. As this is an end-of-the-quarter meeting, the Fed will present its dot plots, which will likely signal that the probability of a further increase in interest rates has only grown higher. At the March meeting, the median dot for policy rates for 2023 was 5.125%. We expect the latest dot plots to show that the consensus is now for rates to peak at 5.375%, reflecting the likelihood that more Fed governors now believe that the interest rates need to rise still further. The Fed is also likely to cut its year-end unemployment rate forecast from the current 4.5% and increase its 2023 GDP forecast from the current 0.4%.

In a speech last week, vice chairman of the central bank’s board, Philip Jefferson, laid the ground for a likely skip in raising rates, arguing that “A decision to hold our policy rate constant at the coming meeting should not be interpreted to mean we have reached the peak rate of the cycle.”

The market currently prices a 31% risk of a rate hike due in part to the recent stronger-than-expected economic data and the surprises sprung by the Bank of Canada and the Reserve Bank of Australia. Last week, the Bank of Canada, which had been on hold since January, increased the overnight rate to a 22-year high of 4.75%. The market currently prices a 65% chance of another rate hike in July and has fully priced in a further tightening by September. Inflation in Canada has been stubbornly high, and the economy continues to show signs of overheating. Meanwhile, Australia’s central bank also defied market expectations and increased interest rates by a quarter of a percentage point to an 11-year high and warned that it could tighten further. Many economists expect the central bank to increase interest rates by a further quarter point at its meeting in August.

The Fed also finds itself in a bit of a spot of bother since the US inflation report is due out on day one of the central bank’s two-day FOMC meeting. The consensus view is that headline inflation will fall to 4.1% from 4.9% and core inflation, too, should ease to 5.1% from 5.5%.

Across the Atlantic, there is little speculation, though, around what the ECB’s decision will be, with a 25bps rise in the reference rate widely expected by the market. Of greater interest will be the forward guidance, with a further increase in rates unlikely to be ruled out. The market currently prices a terminal rate for the current cycle of rate increases at 3.75%, which is 50bps above the current levels.

The Bank of Japan also meets this week, but is not expected to embark on a significant modification of its yield curve control (YCC) just yet. However, it is also clear that the Japanese central bank is set on a path of adjusting its monetary policy step by step. In April, the BoJ removed the interest rate guidance. We may see the central bank widen the bands or raise the targets for the YCC.

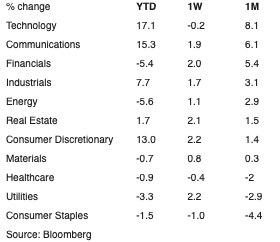

US equities need new sector leadership to make further material gains

Back in the US, a skipping Fed and growth that is holding up better than expected should help the US equity market extend its current run of positive performance. The main challenge to the market’s performance is the lack of sector rotation. The 40bps increase in the US 10-year government bond yield since early May presents a headwind to the performance of growth stocks such as technology shares, which had previously provided the lion’s share of the market’s performance. There were hopes that the energy sector would help but Saudi Arabia’s move to announce a production cut at the recently concluded OPEC meeting has not led to a sustained rally in oil prices. We note that REITs have performed better of late as they move to discount a potential peaking of the rate tightening cycle.

Table 1: S&P500 sector performances – Is the Technology sector’s leadership waning?

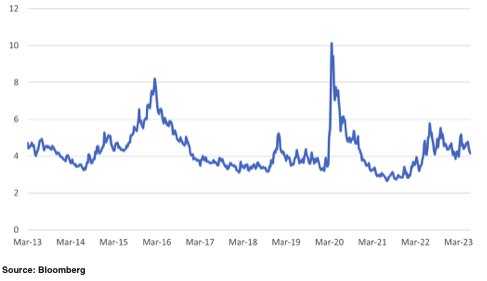

Be wary of US high yield bonds

US Bond markets have been more circumspect than equities about the prospect of monetary tightening. One asset class to be wary of is high yield bonds. Defaults have started to inch up in recent months from 1.6% at the start of the year to 2.4% through May. Despite higher defaults US high yield spreads remain relatively low at 416bps. In our view spreads could easily widen out to 500-600bps. We advocate an underweight.

Chart 1: US high yield spreads don’t look good value

Japanese equities gain support from growth – Overweight

The revisions to the first quarter GDP estimate were quite a positive surprise, with the reported 2.7% quarter-on-quarter growth compared to the initial estimate of 1.6%. The main surprise came from an upward revision to capital expenditure. Increasing to a quarter-on-quarter growth of 5.6%, up from the initial estimate of 3.8%.

China – still waiting for the magical economic stimulus – cautiously optimistic

Key data releases this week include industrial production, retail sales and fixed investment. While headline numbers for year-on-year growth may look good, the sequential monthly growth remains benign. After last week’s weaker-than-expected export growth (-4.6% month-on-month), the pressure remains on the Chinese authorities to stimulate the economy. Economists expect a further cut in the reserve requirement ratio to boost lending. However, the economy wants an injection of confidence, particularly among industrialists. More monetary easing is likely to have a limited impact.

Table 2: Consensus forecasts for key Chinese economic data due this week

China’s equity market has drifted to close to its lows for the year in sharp contrast to the rest of the world hence we are more sanguine about being patient for performance.

Chart 2: CSI 300 Index for Chinese equities