Still robust growth and more inflation

- Financial Insights

- Market Insights

- Major development at G20, not to be underestimated – India-Middle East- Europe Economic Corridor

- More evidence of robust growth and inflation in US

- Oil prices remain on a tear

- China’s political challenges from within

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

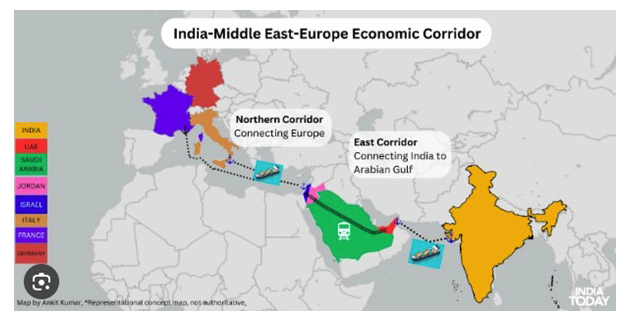

Do not underestimate one of the key agreements at the G20 meetings in Delhi India, the announcement of a landmark India-Middle East-Europe Economic Corridor. The initiative has huge potential implications.

- Re-centering the future of global trade to India-Middle East

- The engagement of Israel in a global trade route and with the key partners of KSA and UAE

- A potential enormous stimulus to long term economic growth in India

- A huge stimulus to ME regional growth which will hopefully dampen some of the ongoing tensions with Iran, and the unresolved Palestine issue.

- A competitor to the One Belt One road initiative

In the future, the very telling absence of Xi Jinping from the G20 meeting may be looked back on as a further signal of the diminishing influence of China on future patterns of global trade.

Robust growth and Inflation

Week after week, economic data out of the US has continued to signal that US economy remains on a firm footing. Last week was no different. Pragmatism would have one believe that in a scenario such as this, the market would move to discount a slightly higher risk of a further Fed funds rate hike. However, in our view, the market is taking a rather sanguine view of the need to reverse the ongoing significant stimulus that continues to prop up the economy but one that also somewhat distorts the inflation story. While two aspects of the economic stimulus, viz. real interest rates and a significant fiscal boost remain well entrenched into the US economy, they have presented policymakers with a confounding challenge – keeping a firm grip on inflation while not derailing the economic recovery.

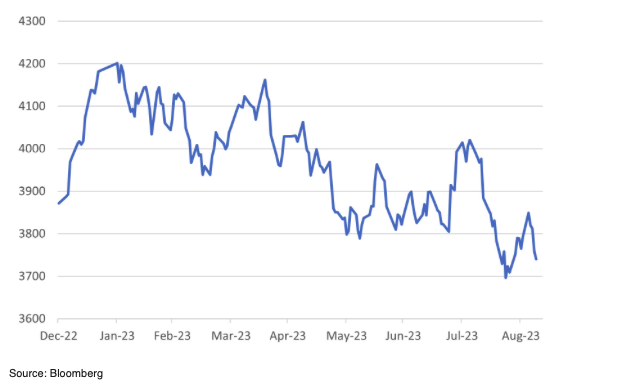

Positive real rates but loose monetary policy in a historical context

Although the Federal Reserve’s FOMC has been (belatedly) diligent in raising interest rates, given the ongoing inflation pressures, the rates themselves are still not at a level that we would ordinarily characterise as a feature of a tight monetary policy. To be sure, we at least have a positive real rate. However, the real interest rates are far from where they have been at times of previous spikes in inflation. Judging by history, a real rate of 250bps to 500bps might be more appropriate.

Chart 1: US Fed Funds Rate Deflated by Core PCE Inflation

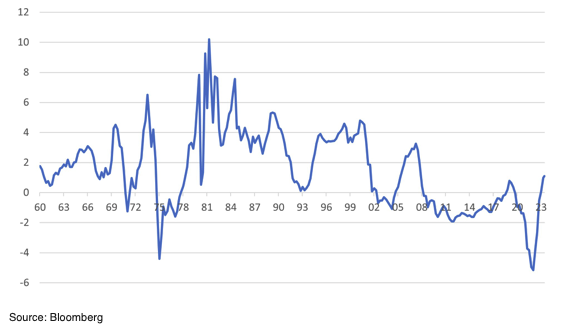

Loose fiscal stance has compromised monetary policy

Part of the challenge for the Fed is that the government is not doing anything to help slow the inflation pulse in the economy – in fact, is it quite the reverse. The so-called inflation-reduction bill is a complete misnomer as it has increased inflation pressures in the economy by being growth stimulative. Although the Biden government has used the policy to advance a laudable green agenda, it is effectively a sop to help the economy transition from the massive COVID stimulus to more balanced times. The result, the US budget deficit, which was at 4.2% of GDP, has widened to 8.5%.

Chart 2: US Federal Budget Deficit

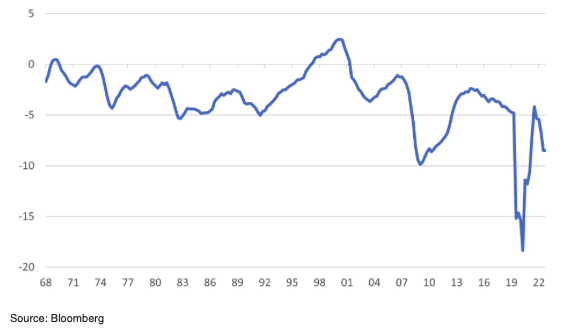

If we try to aggregate the impact of fiscal and monetary policy together (and this is indeed an imprecise art!), we can see that the US economy is still enjoying generally favourable policy conditions (Chart 3).

Chart 3: Net Impact of Aggregated Fiscal and Monetary Policy on the US Economy

In the future, we expect the impact of fiscal policy to move back to being neutral-to-mildly restrictive. However, with one eye on the presidential election, the government may be tempted to not make things complex. If for any reason, things do get tough in the economy, as we saw during the mini-banking crisis earlier this year, the policymakers will perhaps read out of the global financial crisis playbook – launch stimulus, more stimulus, and yet more stimulus!

This week’s US data flow will likely keep the ‘data watching’ Fed on pause mode when it meets on the 19th and 20th of this month. The US consumer price inflation report should show that headline inflation has re-accelerated to 3.6% from 3.2% but that core inflation, ex-food and energy, has moderated to 4.3% from 4.7%.

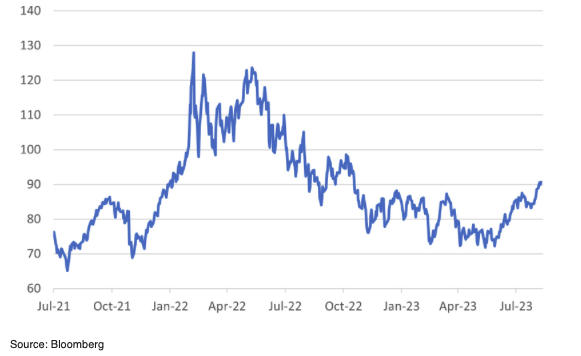

Oil prices still on a tear with supply side constraints

It would not be wise to believe that the moderation in some inflation measures signals that the central banker’s job is done. Oil prices are still on a tear, after OPEC+ remained committed to production cuts. The Brent oil price moved through the $90 mark at the end of last week and is now up 14% from the monthly average at the end of July. The 25% increase in oil prices since June is the most significant spike since the climb to $120 at the start of 2022 amidst the intensifying war in Ukraine. There have been signs that the oil price will consolidate around the $90 level, although the supply-demand dynamics have further worried investors about supply-side constraints. The Biden administration still has to rebuild the US’ strategic oil reserves.

Chart 4: Brent Spot Oil Price

China – The pressure within

The Chinese asset markets may not be waiting the fate that we had feared. Chinese President Xi Jinping is understood to be coming under pressure from retired communist party elders on the economy’s poor performance is something that is unprecedented. Nikkei Asia was the first to report on the development. In a story titled, “Xi reprimanded by elders at Beidaihe over direction of nation”, Nikkei noted that although the discussions were private, details had begun to emerge of how the party elders were unhappy with the direction that the economy was taking.

The report also went some way to potentially explain Xi’s absence from some of the BRICs forum and his complete absence from the G20 meetings. Was it that the president wanted to avoid facing questions about the economy’s underperformance? In any case, we see the pushback as encouraging. There have been times when investors have been concerned that the Chinese leadership did not care about the loss of momentum in the economy. We take it as positive that there is pressure within the country for a change of direction this time.

Chart 5: CSI 300 Index struggles to consolidate