Positively Negative

- Financial Insights

- Market Insights

- Both equities and bonds delivered negative returns in August in a positively corelated way

- Ongoing gap between Fed’s signalling on rates and the market’s forecast

- Market prices no further rate hikes and five Fed funds rate cuts by the end of 2024

- China sees a modicum of better news after foreign capital outflows

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

August saw a repeat of the 2022 syndrome. Like in 2022, both equities and bond markets delivered negative returns in August. The basic tenet of a diversified multi-asset portfolio is that equities and bonds are negatively correlated. Although equities notched up decent gains since the start of the year, the markets overall have found it tough to shake off the inflation worries, which has weighed on both equities and bonds.

Table 1: Key Asset Market Returns for August

Equities

| Developed Markets | -2.6% | |

| Emerging Markets. | -6.4% | |

Bonds

| Global Aggregate (Hgd) | -0.1% | |

| Investment Grade Bonds | -0.6% | |

| Emerging Market Debt | -1.2% | |

| US High Yield | 0.3% | |

Encore 2022

The correlation between bonds and equities turned positive in the middle of last year as markets increasingly acknowledged the inflation problem, which, they realised, could not be just wished away. This made markets anxious. Higher for longer inflation remained at the core of the financial markets’ anxiety even as optimism that a nice soft landing with reasonable growth and a drop in core inflation was on cards began to take hold. Not much has changed since, and the bond and equity markets are likely to remain positively correlated for good or bad reasons, in our view.

Chart 1: The Correlation Between Global Equities (TR) and Global Aggregate TR Index

With the Fed, by its own admission, firmly focussed on day-to-day data to gauge the direction of the monetary policy, investors have been carefully analysing every data point for inflation risk. In the early part of last week, the market interpreted the economic data flows as helpful to asset prices. The market drew comfort from the US labour market report that showed a sharp increase in new job creation to 187,000 from the previous month’s downwardly revised 157,000. Investors were pleased to see a sharp increase in the number of people making themselves available for work, which pushed the unemployment rate down to 3.8%. Meanwhile, average hourly earnings inched up only 0.2%. However, Friday’s ISM survey of the manufacturing sector was the type of economic data that had worried the markets through much of August. The ISM survey showed a rebound in the manufacturing sector and a surge in prices paid and employment.

The US 10-year yield rose 7bps on the day, although it was down 6bps on the week. The yield curve steepened with short-term bonds rallying sharply – the two-year yields nosedived 16bps versus just a 2bps drop in the 10-year yield. Equities gave back some of the decent gains seen early on Friday and despite ending the week up around 1.5%, they were off their best levels.

The market has moved to discount only a marginal risk of a further Fed funds rate increase and five rate cuts by the end of next year. In our view, the market is getting it wrong. Even as recently as the end of last week, the Federal Reserve Bank of Cleveland President Loretta Mester was perhaps only acknowledging the market’s predicament when she noted that US inflation remains too high, and the labour market is still strong. Mester is only one among many voices at the Fed, but it only highlights the widening gap between the Fed’s perception and the market’s hopes.

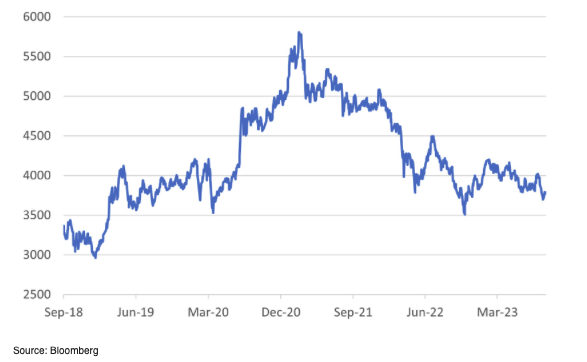

Chart 2: Market Discounts a Marked Cut in Fed Policy Rate Through 2024

China – A sigh of relief

As authorities in China continued to provide a drip feed of policy adjustments to help prop up the economy, Chinese asset markets stabilised last week and investors heaved a sigh of relief. The measures announced were mainly in the housing market. As JP Morgan points out, the proposal to lower the minimum down-payment ratio for mortgages was the first nationwide demand-side policy easing since 2015.

Last week’s economic news flow in China was also helpful. The Caixin survey of industry confidence surged to 51.0, inching past 50.0 and implying economic expansion. Indeed, in aggregate, the economic surprise index has improved off a very low base.

Chart 3: China’s Economic Surprise Index Bottoms Out

Importantly, the better economic data has helped arrest the freefall we had seen in the equity market, at least for the moment. The market’s better performance last week comes after news that foreign investors sold a record $12bn of Chinese stocks in August. The total net sale of equities was the highest since records began in 2014.

Chart 4: CSI 300 Stabilises on Better Economic Data