Macro and Markets Monthly August 2023

- Financial Insights

- Market Insights

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

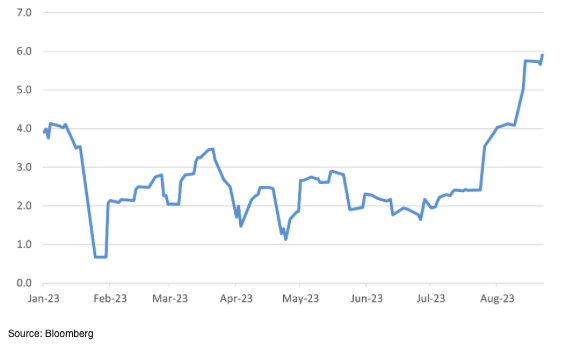

The global economy has become one of marked contrasts between the robustness of US growth and the struggles of Europe, particularly China. Robust economic data out of the US in the early phase of the month led to economists upgrading their GDP forecasts. Indeed, the Nowcast data from the Atlanta Fed had the US growing at a 5.9% clip through the early part of the month.

Europe, by contrast, has been disappointing, with an increasing fear that Germany may have slipped into a recession. While at one stage, the ECB thought it might have to increase interest rates further, very mixed growth data and some signs that core inflation is settling back have helped to reduce the risk of an ECB rate rise at the next meeting to a 50-50 call at worst.

Chart 1: Nowcast estimate of the current pace of US GDP growth

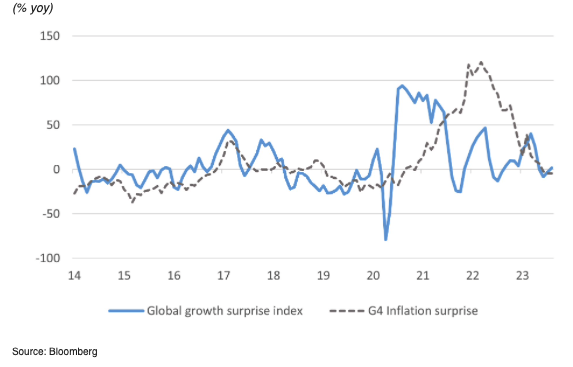

Global growth and inflation data have been much more subdued (Chart 2). Inflation is no longer giving us the big positive surprises of earlier this year; it is not surprising that the downside and the central banks’ concern have continued to remain stocky at higher levels. In many cases, core inflation is running at twice the central banks’ target.

Chart 2: Global economic surprise – inflation and growth

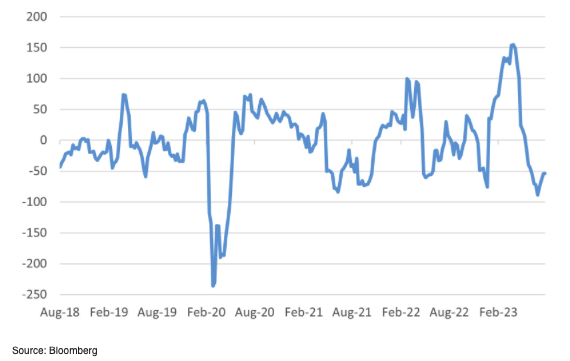

China has been the country of angst, with activity data relatively weak and ongoing problems in the real estate sector. The government seems reluctant to provide a significant stimulus to the economy. Unfortunately, the concerns with Chinese growth are affecting sentiment across the region. China’s re-opening was supposed to give a fresh stimulus to the Asian region – to date, it has been underwhelming.

Chart 3: Economic surprise for China points to significant loss of momentum

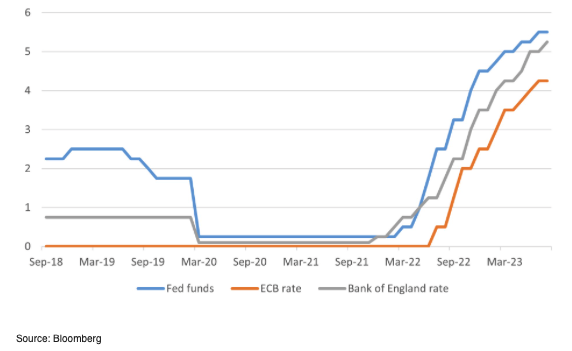

Central banks continue to raise interest rates, although a themes for the market is who will pause next. The Reserve Bank of Australia has already skipped three meetings now in this rate-raising cycle. The Fed has paused but continues to threaten to raise again – the market prices a very low probability of a US rate rise between now and the end of the year. Indeed, the market prices five rate cuts through 2024. With European growth slipping, what was previously seen as a very likely rate rise in September is now down to a 25% probability.

Chart 4: Central Banks continued to raise rates

The US 10-year government bond yield has held above 4.0% and indeed at some stages of August looked like it could break much higher. Analysts are becoming more concerned with persistent selling by the Chinese, the huge government debt and ongoing exceptionally high US government fiscal deficits.

Chart 5: US 10-year bond yield

Markets

Equities

Equity markets were down across the board as fears for further rate increases, ands the higher bond yields weighed on sentiment. Signs of stronger than expected growth in the US did little to help. There were very limited signs of upgrades to consensus profits forecasts outside of the technology sector, which may indicate that companies are struggling to hold onto the level of their margins given cost pressures.

Emerging market equities were much weaker than their developed market counterparts. In part the weakness was generated by the dollar’s strength, but by market China was a particular drag. Ongoing problems in the real estate sector weighed on sentiment in the absence of a meaningful policy response from the Chinese policymakers.

Table 1: Equity Market total returns in July August

| US Equities | -1.6% | |

| Europe ex UK | -4.0% | |

| Japan equities | -1.7% | |

| UK equities | -3.4% | |

| Switzerland | -1.6% | |

| Asia ex Japan | -6.6% | |

| Russell 2000 | -5.2% | |

| FTSE Small | -3.2% | |

| India | -2.5% | |

| China | -5.2% | |

| Brazil | -5.1% | |

| Singapore | -4.2% | |

| Emerging Markets | -6.4% | |

| Developed Markets | -2.6% | |

Source: Bloomberg

Only the energy sector amongst the major managed to generate a positive returns for the month. With OPEC+ continuing to try to limit the amount of oil supplied to the market, oil prices rose, and the energy sector followed. Banks had a particularly poor month as investors continue to fret over potential future credit losses and the more restrictive environment for profits growth.

Table 2: Equity Market returns by sector in August

| Energy | 1.2% | |

| IT | -2.0% | |

| Consumer staples | -3.6% | |

| Healthcare | -0.8% | |

| Banks | -7.1% | |

Source: Bloomberg

Bonds

Bonds, like equities, struggled to make any headway in August. The prospect of higher-than-expected inflation for longer and central banks still on a tightening path led to very modest returns at best. High yield continues to perform well as the market was happy to bet on a soft landing for the economy, even if rates are high.

Emerging market debt returns were particularly disappointing after some good returns in previous months. The difficulties in China, a stronger dollar, and another African coup all worked against the asset class. A leading candidate was murdered in Ecuador, and Nigeria admitted it had fewer reserves than previously thought. Also, we have seen some of the EM countries signal that they will likely maintain their tight policies. South Korea pledged to keep its monetary policy tight, and the Bank of Indonesia said it would allow short-term interest rates to rise to support the rupiah.

Table 3: Bond market returns

| Global Aggregate (Hgd) | -0.1% | |

| Investment grade bonds | -0.6% | |

| Emerging market debt | -1.2% | |

| US High Yield | 0.3% | |

Source: Bloomberg

FX and Precious metals

With the US$ in the ascendancy both gold and silver were weak. The dollar was particularly strong against the Yen given the ongoing loose monetary policy being maintained by the Bank of Japan.

Table 4: Monthly performance of precious metals and currencies for August

| Gold | -1.3% | |

| Silver | -1.2% | |

| $ trade weighted | 1.7% | |

| GBP trade weighted | -0.1% | |

| Yen/$ | 2.3% | |