Japan Inc is back…

- Financial Insights

- Market Insights

- The current rally in Japanese equity market looks well supported by evolving positives

- Ongoing corporate restructuring should facilitate a further material rise in the equity market

- Relative to history a further 10% rally in the Nikkei 225 is not ruled out

- Chinese equities, on the other hand, have been beaten up by a run of poor economic data and selling pressure from foreign investors

- The setback in Chinese equities probably offers a buying opportunity

Gary Dugan

The Global CIO Office

Japan is back…well, at least the equity market is back to where it was more than 30 years ago. Maybe – just maybe – the corporate sector will build on its growing credibility with foreign investors to propel the market to all-time highs.

Chart 1: Nikkei 225

Japanese equities – how many legs are in this rally?

We can finally believe that corporate Japan is seeing a material change in its attitude towards corporate governance and investor returns. In our view, the measures announced by Tokyo Stock Exchange at the start of the year requiring Japanese quoted companies to improve their returns on capital could materially alter the corporate Japan landscape. In fact, corporate Japan has responded more aggressively in response to those measures than we might have initially thought, resulting in visible efforts to increase returns on capital and improved shareholder returns.

Nomura’s results, for instance, could be a seminal moment for corporate Japan. The CEO, under whose leadership net income has fallen for three straight years, announced that the firm is assessing “all of the front, middle and back offices” to drive the return on equity up from the current 3.1% (year-ended March) to 8% to 10% over the medium term. The opportunity for Nomura’s management is enormous when one considers just how inefficient the company has become. The cost-to-income ratio of the wholesale banking business currently stands at 96%, which the brokerage targets to cut to 80%; the rest of the world would consider 60% to be a more relevant target. The importance of the cost-to-income ratio lies in its ability to provide insights into a bank’s efficiency in managing costs and generating revenue.

We are seeing the greatest level of confidence among foreign investors in corporate Japan to deliver something special in terms of restructuring since the launch of “Abenomics” in 2013. The measures announced by the Tokyo stock exchange at the start of the year to pressure companies to improve their returns boosted foreign investors’ confidence into increasing their exposure in the country. Given the increased concerns about corporate leverage around the world, it will be of immense comfort to global investors that the net debt-to-equity ratio for corporate Japan sits at 35%, sharply lower than the rest of the world’s average of 50%. Another positive has been the highest wage agreement since the 1990s between employers and unions, known as “Shunto”.

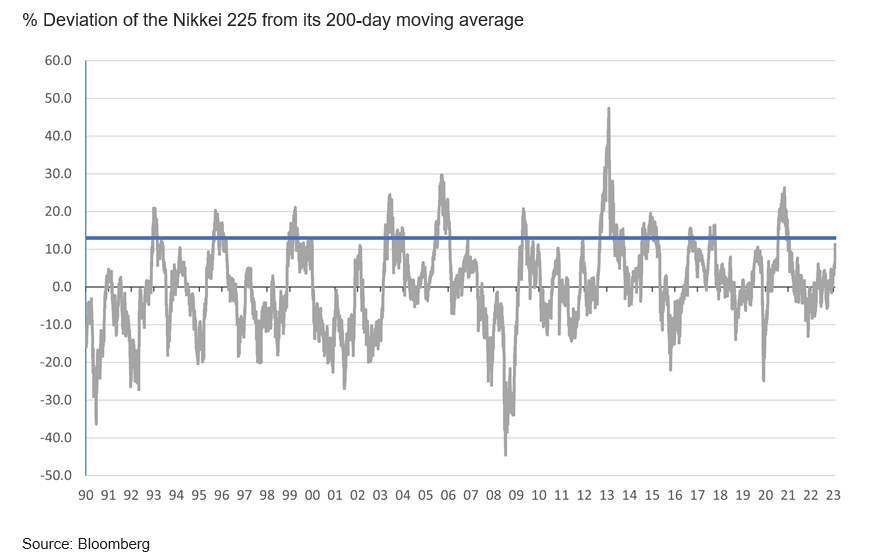

Japanese equity indices are back to levels not seen since the early 1990s, at close to the absolute peak of the market. It then begs the question as to how much further the Japanese equities rally can stretch and how strongly this rally differs from the past. Japanese equities are now around 15% off their low of mid-April. However, on some metrics, the rally has further room. We have used one technical metric that looks at the index level relative to its 200-day moving average (Chart 2). The market is currently about 10.5% above its 200-day moving average. However, events of the past 30 years tell us that such a rally is not unprecedented; it is less than a one standard deviation event (marked by the blue line). Given the slew of factors currently supporting the market, the rally stands every chance of moving closer to the 20% mark, implying a further 10% rally on the index is not out of question.

Chart 2: Japanese equities rally still short of previous bull runs

The G7 meeting in Hiroshima seeks better engagement with China – at least that’s what they say.

The focus of global geopolitics was also on Japan last week with the G-7 meeting in Hiroshima, the place where the first nuclear bomb exploded in the Second World War. Pictures of world leaders laying flowers at the Hiroshima Peace Memorial was certainly a sombre moment, but it has a larger significance – that of making global peace the primary objective.

In the communique at the end of the meetings, some of the comments on the relationship with China were, at least on the surface, constructive. “Our policy approaches are not designed to harm China, nor do we seek to thwart China’s economic progress and development”. The statement is understood to be the culmination of over two years of diplomacy to draw the countries attending to a common approach and framework for handling China’s emergence as a significant economic and political power. For the markets, it should be encouraging that the G7 talks of “de-risking” of relationships with or “decoupling” from China.

However, many warm words from G7 on China don’t necessarily translate to better performance from Chinese asset markets. In China’s eyes, though, the communique could have been more helpful. China’s foreign ministry condemned the statement and made strong representations to the host country.

Chinese asset markets have muddled along in recent months, and the equity market sits in no man’s, down sharply from the levels achieved after the announcement of the re-opening of the economy. Last week’s economic data releases for April were much weaker than expected. Industrial production was up only 5.6% year-on-year compared with market expectations of +10.9%. Retail sales were up 18.4% year-on-year compared with market expectations of +21.9%, and fixed asset growth at 4.7% year-on-year was against market estimates of +5.7%. The market needs a catalyst of better news rather urgently. The government, though, seems circumspect in providing the economic stimulus the market desires.

We expect the Chinese authorities to rescue the economy and, by implication, the market at some stage. Patience holds the key here. However, the market is cheap, unloved, and under-owned by foreign investors considering the significant selloff in April. Reuters reports that non-residents sold nearly $4 billion of Chinese stocks in April, according to the Institute of International Finance, the first outflow in six months.

Chart 3: MSCI China net total return (USD) Index in no man’s land