Inflation Fight

- Financial Insights

- Market Insights

- US and UK inflation surprises to the upside

- Market now prices a high risk of a further 25ps Fed rate increase at June meeting

- US 10-year government bond yield getting closer to offering real value

- Bank of England lacking credibility in its inflation fight

Gary Dugan

The Global CIO Office

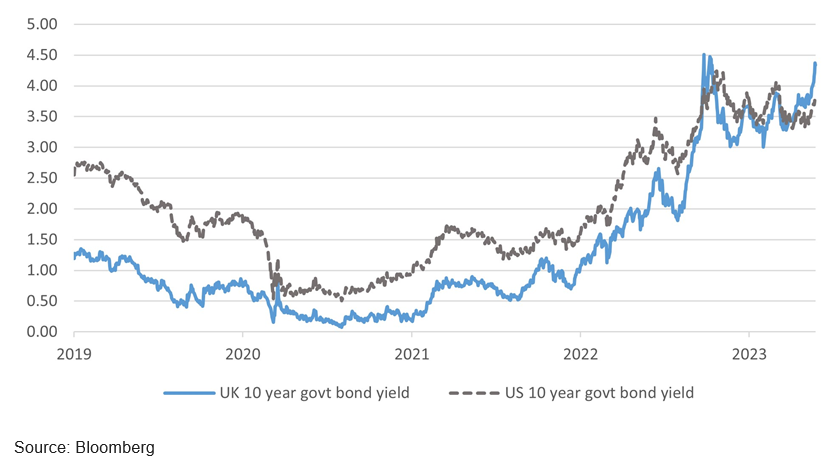

The market’s wishful thinking is not coming to fruition. Inflation continues to be a problem. Last week’s economic data releases showed core inflation in the US and UK is on the rise (Chart 1). Importantly, the market has finally begun to price the Fed’s message of higher-for-longer policy rates.

Chart 1: US core PCE deflator and UK core inflation on the rise

US – the continuing uptrend in inflation boosts calls for more rate increases

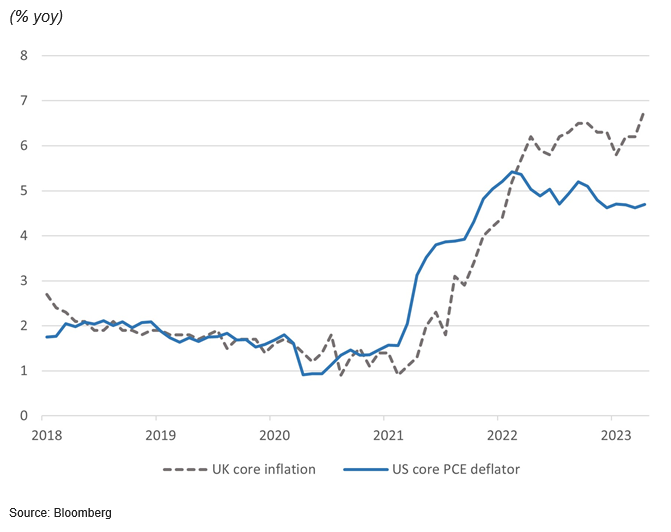

We have long been steadfast in defending our (sometime contrarian) view that inflation would prove to be a much more persistent problem than the market perceives. Last week, the markets finally put a stamp of approval on our long-held view, appearing to dramatically shift expectations for how the Fed will tweak its policy going forward. From persistently expecting rates to decline from where they have been for some time now, the market now prices a significantly higher probability of the US central bank increasing interest rates at its next meeting in June. Indeed, the market, in a departure from its earlier view, also prices a lower probability of marked rate cuts by January 2024.

Chart 2: Market pricing of future Fed funds rate as of May 28th

Chart 2a: Market pricing of Fed funds rate as of April 28th

US Fed governors’ continued messaging to the market has been amply clear – that the economic data flow has been resilient increasing the risk that inflation will persist for longer than previously expected. Data released last Friday showed that the personal consumption expenditure deflator, Fed’s preferred measure of inflation, rose to 4.7%. The surge prompted Federal Reserve Cleveland board member Loretta Mester to comment that everything is on the table in June…“the data that came out this morning suggests that we have more to do”.

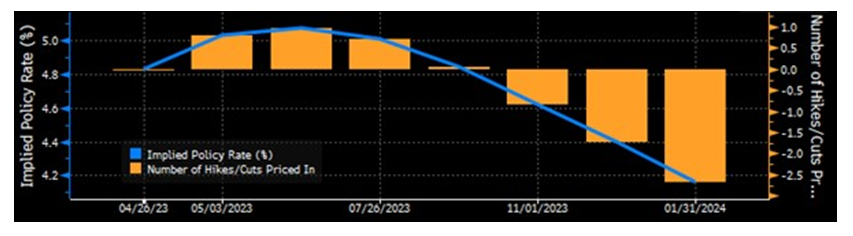

The rise in long-term government bond yields boosts our hope that a real yield is now possible

The rise in market expectations for future Fed rate increases prompted a 12-basis point surge in the US 10-year government bond yield to 3.80%. In just 12 trading days the US 10-year yield has risen 40bps, underlining how quickly investor sentiment has changed. Yields nearing the 4.0% mark gets us closer to seeing the 10-year bond provide a long-term real yield premium. Various commentators and economists see 3.0%-3.5% as being the likely value of the ‘sticky inflation’ that the market remains concerned about. Hence, any significant yield premium over 3.0%-3.5% will make investors comfortable that they are buying an asset that will not erode the real value of their wealth. Historically, the real US 10-year yield has fluctuated largely between 0% and 2%.

Chart 3: US 10-year bond yield adjusted for inflation

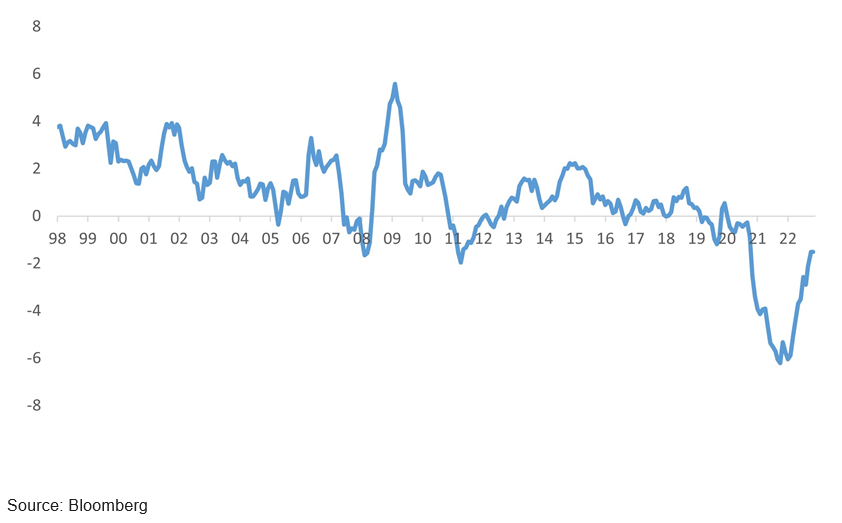

UK inflation trouble

The latest UK consumer price data for April certainly has markets worried about how entrenched inflation is into the system now. We had already highlighted our concerns about the UK (see Weekly published May 1st ). While the year-on-year change fell to 8.7% from 10.1%, the decline (as increases in energy cost ebbed) was more modest than expected (8.4%). Food prices are one reason for supply shocks due to weather conditions, but core inflation remained worryingly high at 6.8%. Furthermore, price increases in April were widespread, leaving the UK with one of the worst inflation records in Europe at present.

The financial markets are clearly alarmed if the Bank of England’s Monetary Policy Committee has lost its way – Governor Andrew Bailey admitted last week to mistakes in forecasting and understanding the inflation dynamics. No surprise, then, that gilts yields are back to levels last seen at the time of the Truss administration’s mini-budget fiasco. With UK real interest rates still negative rate hikes are set to continue in the UK; a peak well above 5% looks possible. That is good short-term news for sterling but makes a pre-election recession almost inevitable despite this week’s upgraded UK outlook from the IMF.

Chart 4: UK 10-year government bond yield rises above the US