Trying to Remain Sober at a Party

- Financial Insights

- Market Insights

- US economic data continues strong, under pinning equity market rally

- US economic data flows only supports Fed reticence to the cut rates

- Some signs that the best of the global disinflation news may be behind us

- As we fret about China, Korean and Taiwanese equity market look to be on a better footing

- Vietnam receives potential support from the US CHIPS act

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

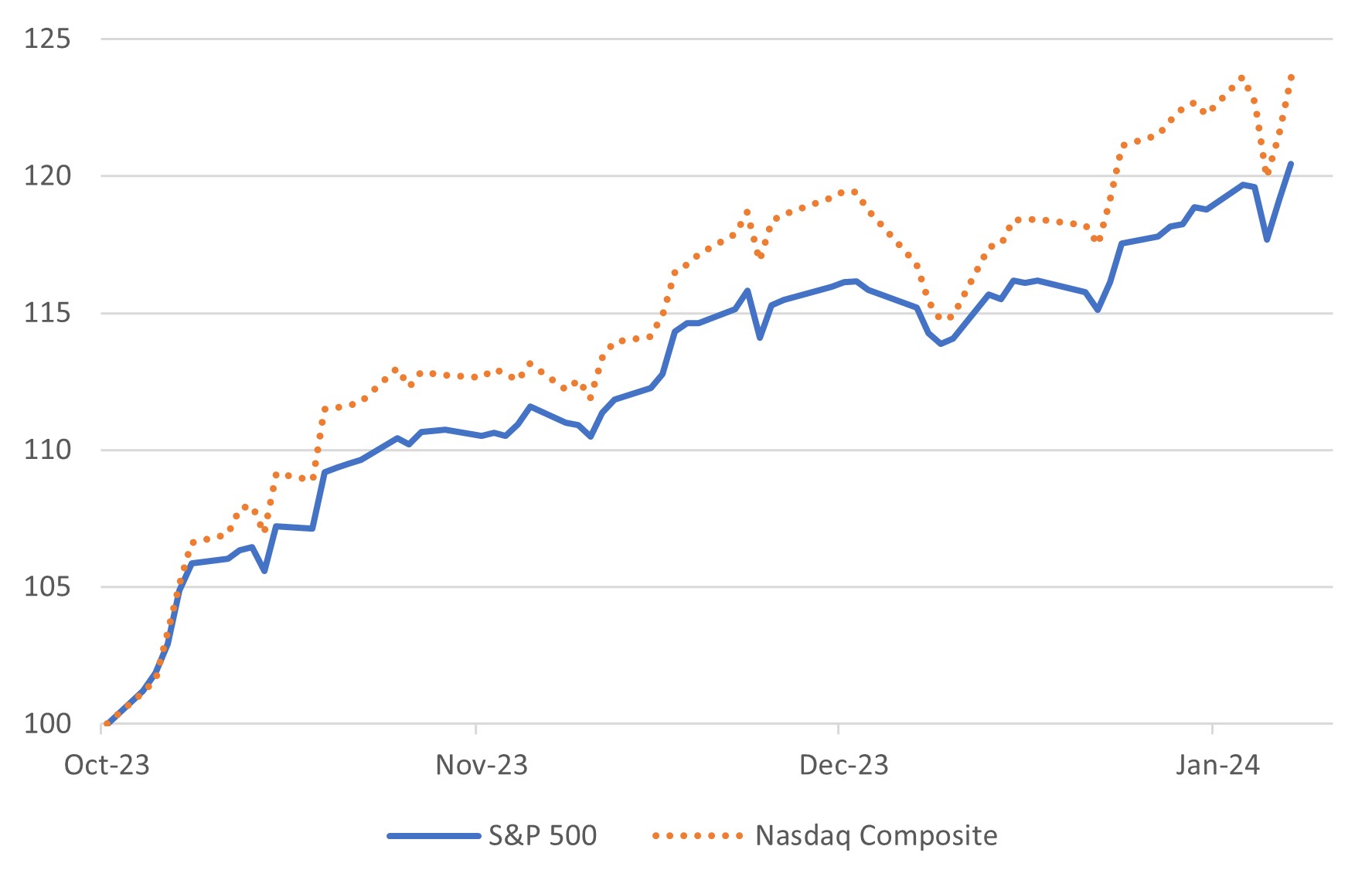

The US equity markets have maintained their upward momentum since the lows of October with gains spreading across various sectors, not just the tech industry, which often dominates headlines. While the NASDAQ Composite has indeed led the way in performance, the broader S&P 500 has also shown strong gains. Even the Dow Jones Industrial Average lags only four percentage points behind the NASDAQ over the same period.

Why dampen the mood? Our goal is to approach these weekly commentaries with a level of caution. Despite the encouraging signs of robust growth in the US, as indicated by recent data, such expansion can have its drawbacks. Economic growth consumes the spare capacity of an economy, and when resources become scarce, inflation often re-emerges. Although recent months have shown significant disinflation, the current surge in US growth heightens the risk of an inflationary surprise in the near future.

As we observed last week, the Federal Reserve seems to be the cautious observer at this celebration, akin to a guest opting for water instead of champagne. This vigilance hints at the delicate balance the Fed aims to maintain, navigating between fostering growth and mitigating inflationary pressures.

Chart 1: US equity markets up 20% from their October lows

Source: Bloomberg

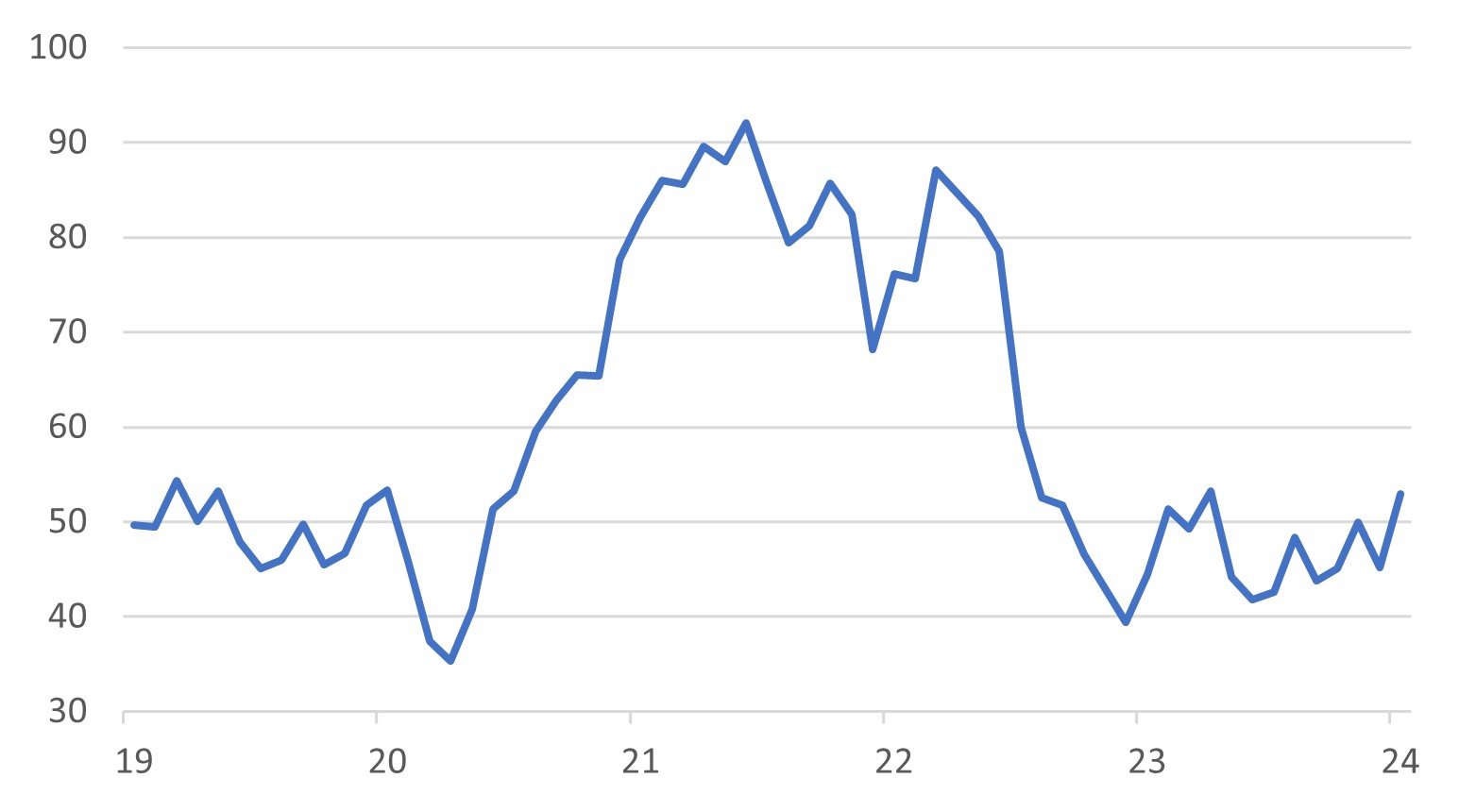

Early last week, the market showed skepticism towards the Federal Reserve’s cautionary stance during its policy-making meeting. By indicating a reluctance to reduce interest rates as soon as March, the Fed communicated its concerns about stimulating the economy further amidst signs of robust growth. This skepticism was dispelled by the end of the week, following a strong employment report that validated the Fed’s cautious approach. The US economy’s continued strength, characterized by vigorous growth, declining unemployment, and quickening wage increases, presents the exact scenario that would concern any central banker.

Chart 2: US Economic Surprise Index on a Tear Higher

Source: Bloomberg

As we have argued in recent weeks, the recent surge of growth in the United States has a firm foundation. The January jobs report was significantly ahead of expectations with employment increasing by 353,000 in the month, almost twice the consensus forecast. Of note was the 0.6% month-on-month increase in hourly earnings. While this may be a little exaggerated due to some technicalities, wage growth is now running at 4.5% per annum. The employment report gave a fairly consistent picture of good job gain across industry. Health care (100,000), professional and business services (60,000) and retail trade (45,000) were the highlights.

For the moment, the market may believe that good growth is coming with little inflation threat, we believe that is complacent. Indeed, in some of the recent global economic data there are some signs of an end to disinflation. Some of the recent manufacturing sector surveys in the United States, PMIs have shown that companies are struggling to keep up with demand and are paying up for their supplies. In the Eurozone core goods prices are edging higher indicating that issues in the Red Sea could be causing some disruption to supply lines.

Chart 3: ISM Manufacturing Survey – Prices Paid Index Showing Signs of Upward Momentum

Source: Bloomberg

We sense a little more enthusiasm building for the emerging markets. Taiwan and Korea had been a drag on the broad index compounding the disappointment from China. The good performance from the NASDAQ index had to help Taiwan and Korea at some stage. Taiwan’s Q4 GDP came in above expectations at +5.1% year-on-year. Domestic spending was stronger than expected. In Korea thankfully the tech sector rally has finally lit a fire under the market and as the week closed the index ended with the highest weekly return since November 2022. One of the more structural supports for the market has been the Korean governments announced initiative to “Value Up” the corporate sector; in essence taking a similar direction to the recent changes in Japan that encourage companies to focus on shareholder value. This program targets companies with a low price-to-book ratio (PBR), a metric used to compare a company’s market price with its book value, where a PBR below 1 indicates that the stock is undervalued. The initiative seeks to kickstart a virtuous cycle that elevates the corporate value of these companies, leading to increases in stock prices and supporting corporate expansion.

Key elements of the program include the publication of investment metrics like PBR and return on equity (ROE) for listed companies. These companies will also be recommended to disclose their plans for improving corporate value. The Financial Services Commission outlined that the program would involve new indices and exchange-traded funds (ETFs) made up of companies with high shareholder values as it aims to tackle the problem of undervaluation for stock companies. The program also includes measures such as revising the Commercial Act to enhance the protection for the rights and interests of small shareholders and making regulatory improvements regarding general shareholders’ meetings.

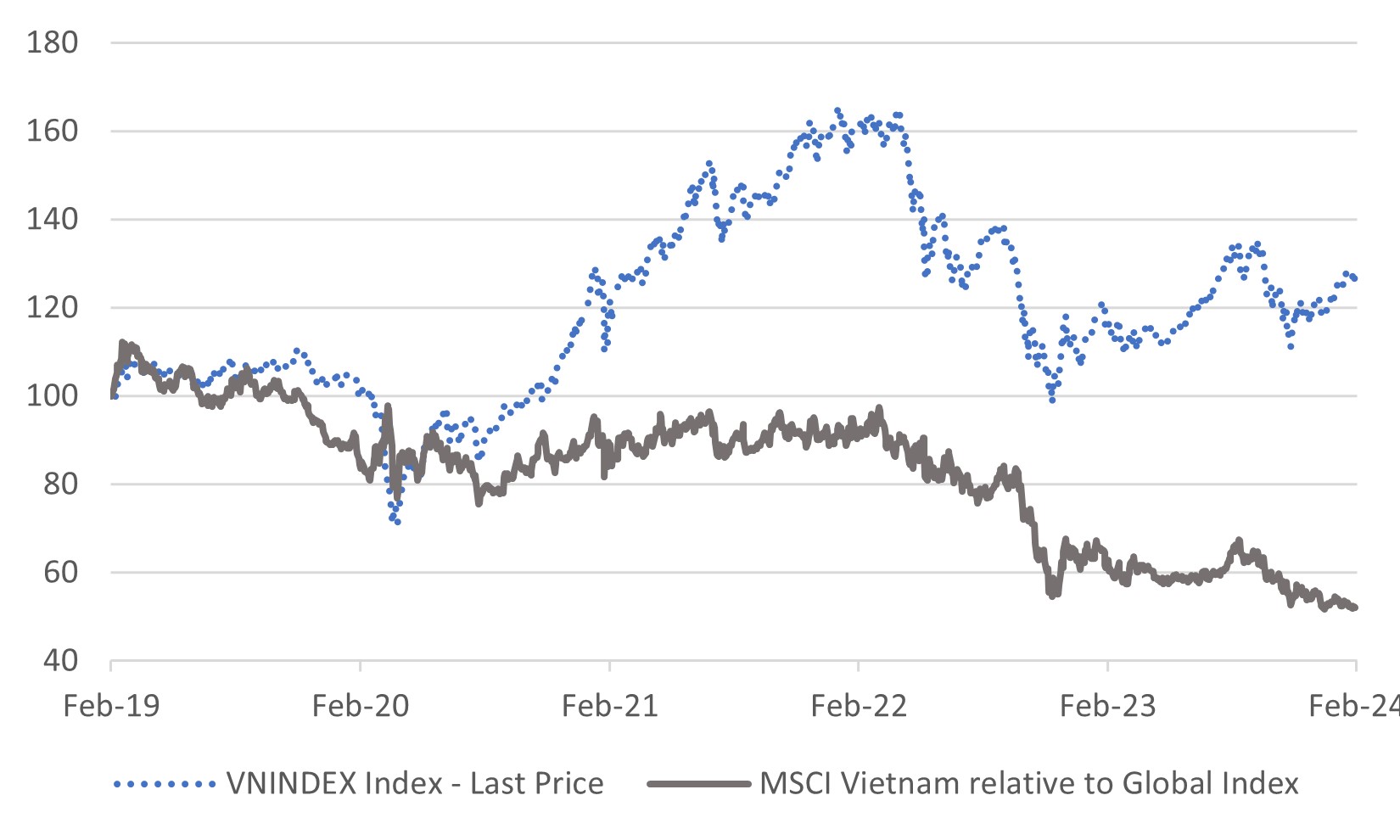

As the market continues to embrace the good news from the growth in the tech sector it is important for investors to embrace investments beyond the shores of the United States. In the past week, the US envoy’s trip to Vietnam highlighted the country’s credentials as an important hub for chip manufacturing in the future. The US are about to allot foreign aid to countries under the auspices of the CHIPS act to countries recommended by the OECD this month. Vietnam is an important country to the United States as it seeks to move away from its reliance on imports from China. Vietnam ranks second globally in its reserves of rare earth metals. The Vietnamese equity market has partly recovered from its marked slump in 2022 but still bears the scars from the anti-corruption purge and clamp down on the runaway property market by the government. Worth keeping an eye on.

Chart 4: Vietnam equity market index and relative

Source: Bloomberg