Macro and Markets Monthly - November 2023

- Financial Insights

- Market Insights

November 2023 – A Quite Extraordinary Month

November was quite an extraordinary month when markets more than reversed the losses for October. We provide additional insights into the happenings in our monthly posted below.

The one stand out was the market participants’ firm belief that the peak in inflation and policy rates is firmly behind us. A majority of central banks are either staunchly on hold or already cutting interest rates. Inflation is trending down because of the sharp drop in energy and food prices. Bond yields have fallen to levels that seem to discount a high likelihood of a reversion of inflation to the Fed’s 2% target. That’s all the good news.

But the exuberance could still easily push prices higher. However, we are at a point where market valuations are rich. The US equity market is trading at a P/E of 22x, which is significantly higher than 2007’s peak of 16.5x. Even Jamie Dimon is warning that the US economy has to slow and the earnings outlook has to deteriorate.

“A lot of things out there are dangerous and inflationary. Be prepared,” Dimon said at the New York Times DealBook Summit in New York on Wednesday…. Who are we to argue!

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

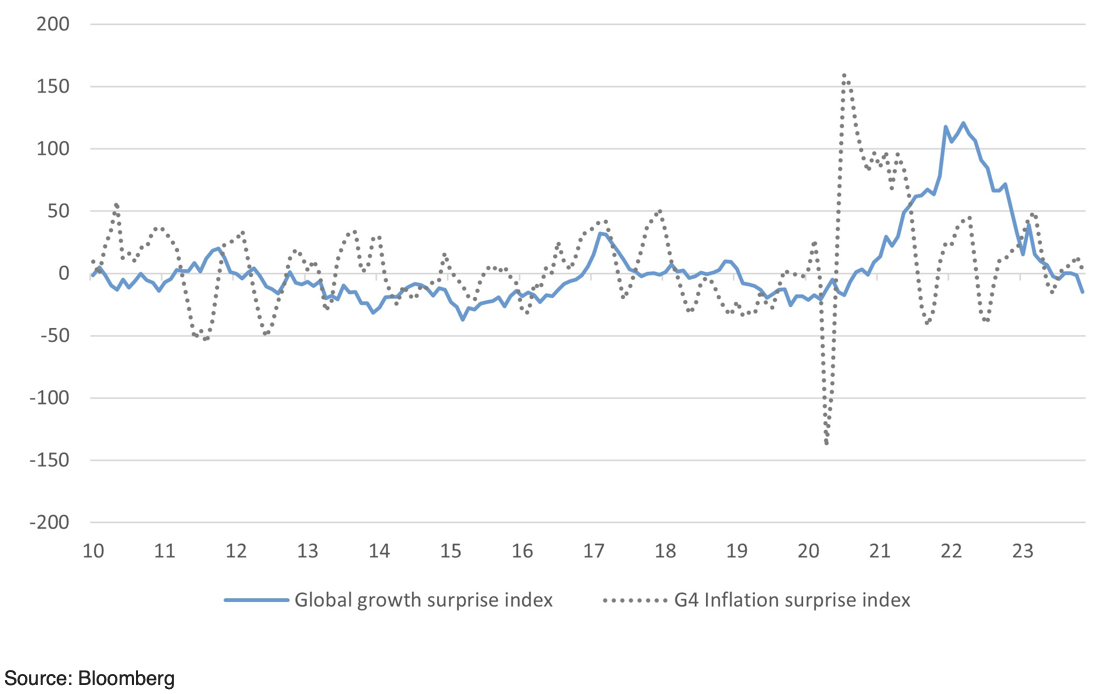

November was indeed quite significant if not entirely extraordinary. It showed that even minor shifts in economic outlook can significantly affect asset markets, potentially reaching a pivotal point. As evident in Chart 1 below, these shifts, though subtle, make us sit up and take notice. While the macro environment has long been besieged by inflation, November brought a much-desired relief in the form of a notable decline in inflation momentum. The markets had a rather pronounced reaction to the positive surprises in inflation data, indicating a perceived shift in inflation risks. According to Reuters, approximately 53% of inflation data came in below expectations, 25% matched predictions, and 22% exceeded them. Oil prices experienced a modest decline of $4 to $5 over the month. This drop signalled to the market a decreased likelihood of oil prices rebounding to around $90, a level that only recently was considered a possibility. Food prices, too, have been on a downtrend. In the UK, for instance, food price inflation decreased to 10% in October from a high of 19%.

Chart 1: Global economic surprise – inflation and growth

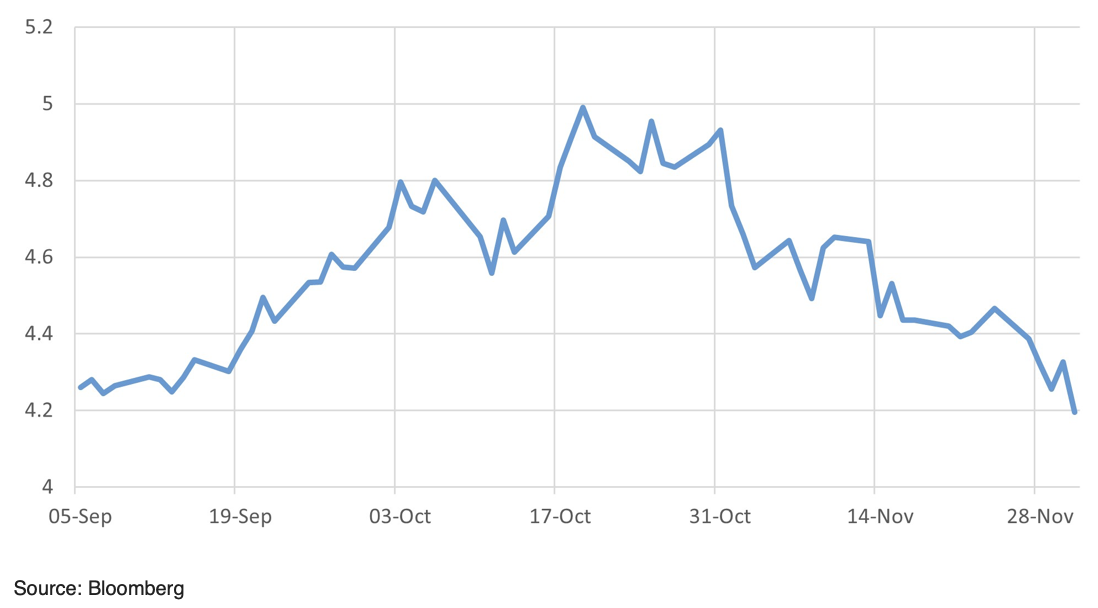

The market’s reaction to the better inflation news was quite extraordinary. The US 10-year government bond yield fell 60bps on the month to 4.20%. The fall in the yields prompted a rally in almost all asset classes. Equities, bonds, and gold all rose on the month; the main laggard was oil, which drifted lower.

Chart 2: US 10-year government bond yields tumble through the month

Given the circumstances, the easiest conclusion to draw perhaps is that central banks are probably done tightening, which is not entirely without basis. Indeed, a majority of central banks have signalled recently that they have hit pause. Others – most notably those in the emerging markets – have started to cut rates. Indeed, a Deutsche Bank report noted that a greater number of central banks are cutting policy rates as opposed to increasing. Out of the 81 monitored, ten central banks slashed rates in October, with a further five joining the ranks in November including Brazil and Peru.

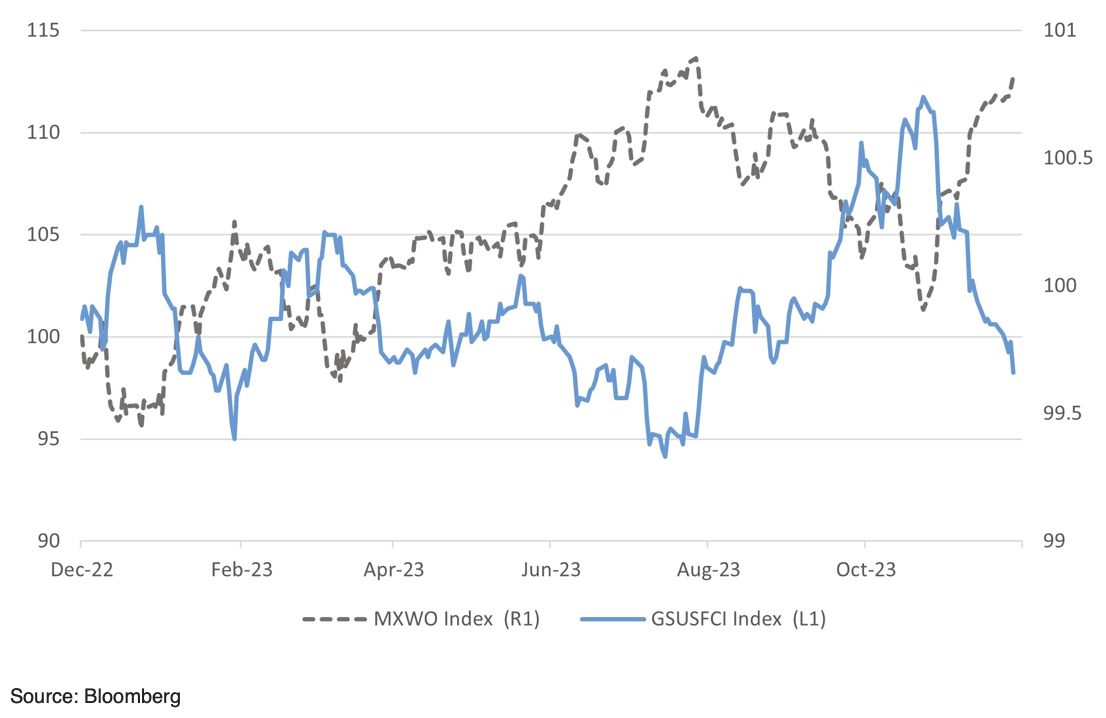

Falling long-term interest rates and the weakening dollar have had the effect of materially easing monetary conditions. Ironically, one of the strongest reasons for the market to believe that the Fed did not need to raise interest rates still further was the increase in long-term interest rates to 5% and the consequent rise in the value of the dollar. According to Goldman Sachs’ estimates, US monetary conditions have loosened significantly since the peak tightness observed last October (Chart 3).

Chart 3: Goldman Sachs Index of US monetary conditions

Markets

Equities

Encouraged by the relaxed monetary conditions, equity markets recorded extraordinary gains in November. Global equities returned 9.4%, more than reversing October’s losses. The monthly gains in global equities was the strongest since 2008. Meanwhile, the dollar’s decline led to Europe leading the gains across major markets. Emerging markets also witnessed healthy gains but lagged developed markets because of Chinese equities’ lingering poor absolute performance. Global equities notched up more than one-third of the returns for the year in November alone.

Table 1: Equity market returns in November

| US Equities | 9.4% | |

| Europe ex UK | 10.8% | |

| Japan equities | 8.6% | |

| UK equities | 2.3% | |

| Switzerland | 4.5% | |

| Asia ex Japan | 6.9% | |

| Russell 2000 | 8.8% | |

| FTSE Small | 4.9% | |

| India | 6.7% | |

| China | 0.4% | |

| Brazil | 14.2% | |

| Singapore | 0.2% | |

| Emerging markets | 7.9% | |

| Developed Market | 9.4% | |

The drop in US long-term interest rates led to a marked rally in growth sectors such as tech. While more defensive sectors such as consumer staples lagged, they nevertheless closed the month with a decent 4.3% return. The energy sector was an obvious marked laggard, held back by the slide in oil prices.

Table 2: Sector returns in November—Global equities

| Energy | 0.3% | |

| IT | 13.7% | |

| Consumer staples | 4.3% | |

| Healthcare | 5.7% | |

| Banks | 11.1% | |

Bond markets

Bond markets have staged an even greater turnaround than equities, with the yield on the US 10-year dropping 60bps on the month. Bond markets that were nursing low returns and losses to the tune of 3.3% year-to-date at the end of October are back into the black, with the global aggregate index inching up 1.5% by the end of November.

Table 3: Bond market returns in November

| Global Aggregate | 5.0% | |

| Global Aggregate (Hgd) | 3.4% | |

| Investment grade bonds | 5.1% | |

| Emerging market debt | 5.3% | |

| US High Yield | 4.5% | |

FX and Precious metals

With the dollar down 3%, precious metals – notably silver – performed well after a period of indifferent performance. Most currencies strengthened against the dollar, reversing some of the marked weakness against the greenback from July through to the start of October when the dollar appreciated by 7.3% in an almost straight line.

Table 4: Monthly performance of precious metals and currencies for November

| Gold | 2.6% | |

| Silver | 10.6% | |

| $ trade weighted | -3.0% | |

| GBP trade weighted | 1.5% | |

| Yen/$ | -2.3% | |