Macro and Markets Review for July 2024

- Financial Insights

- Market Insights

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

As we turned into the year’s second half, the markets finally saw more consistent news of better-behaved inflation. With inflation falling closer to central bank targets, some started to signal that they were at or much closer to the point of cutting interest rates. By the end of July and adding in the first day of August, the Bank of Japan, ECB, and UK MPC had cut rates, and the Fed signalled that it would likely cut rates at their September meeting.

The global growth and inflation surprise indices have moved negatively in recent months. The US appears to have hit a phase of much slower growth, although coming off the back of a second-quarter GDP growth rate of 2.8%, although that growth may have been inflated by a build-up in inventories that may unwind in subsequent quarters.

Chart 1: Global Economic Surprise Indices – Inflation and Growth

Index

Source: Bloomberg

The slowdown in the US economy was most apparent in the labour market, where new jobs rose only 206,000 in July, and the unemployment rate picked up to 4.1%. The Fed has noted the more rapid pace at which the economy is moving to its targets for the looseness of the labour market and the moderation of inflation.

Chart 2: Core PCE inflation Moving Closer to Fed’s Target

Source: Bloomberg

A key feaure of July was the Yen’s sharp reversal of its marked weakness of the previous three months. The Ministry of Finance intervened repeatedly to firstly arrest the Yen’s weakness and then to push it higher against the dollar. At th end of the month central bank tightening of monetary policy will also help the Yen. The BoJ raised its short-term interest rate target to 0.25% from 0-0.1% previously, and said it would taper its bond buying to three trillion yen ($19.53 billion) per month as of the first quarter of 2026.

Chart 3: Remarkable Reversal in the Yen’s Previous Weakness against the Dollar

Source: Bloomberg

In the emerging markets, there was a sharp contrast between the good news coming out of India, the disappointing economic data flow from China, and its seeming policy paralysis. India’s budget was a good reflection of still ambitious investment spending on infrastructure and some modestly populist spending in support of the less fortunate. The finance minister also reported a further reduction in the country’s budget deficit and a strong feeling that the government will be able to run a current account surplus in the coming year.

By contrast, China’s economy looks benign, and the crucial Third Plenum meeting of the Communist Party failed to ignite any hope of a near-term boost to the economy. While the government provided a laudable plan for long-term planning, the economy and markets need a transparent boost. As the month closed out, President Xi Jinping acknowledged that the “focus of economic policies should shift more towards benefiting the people and promoting consumption”.

Chart 4: China’s CAIXIN Manufacturing Sector Confidence Index Drops Away

Source: Bloomberg

Markets

Equities

For a change, the US equity market was leading the pack. The slide in the tech sector, the switch in sector leadership to interest rate-sensitive stocks, and better performance from small-cap stocks contributed to the dollar return from the Japanese market. The dollar return from the Japanese market benefitted from a very sharp rally in the Yen against the dollar; so while the Japanese equity market was down 1.4% in local currency terms, in dollar terms, the market ended up 5.8%.

The poor performance of Chinese equities continued holding back the performance of the EM index. In contrast Indian equities extended their post election rally ending up as one of the best performing markets. The UK equity market showed some life reacting positively to the new Labour government who have a substantial majority.

Table 1: Equity Market returns in July

Equity sector performance

The tech sector, weighed down by some indifferent Q2 corporate earnings reports, saw some profit-taking through July. The results were satisfactory; however, analysts debated whether the market had overhyped the AI phenomenon.

There was quite a switch of money flows into interest rate-sensitive stocks. Banks performed well, continuing the good absolute gains seen over the past year.

Table 2: Global equity sector returns in July

Source: Bloomberg

Bond markets

As confidence built that inflation was coming down and central banks delivered on rate cuts, bonds rallied. This translated into more of a general drop in yields rather than any significant performance from the credit market. Credit spreads remain essentially unchanged.

Chart 5: US 2-year Bond Yield down Sharply as Market Anticipates Fed Rate Cuts

Source: Bloomberg

Table 3: Bond market returns In July

Source: Bloomberg

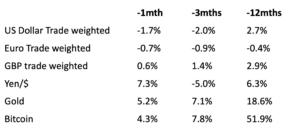

FX and Precious metals

The feature of the month was the sharp rally in the Yen. Ongoing geopolitical issues, particularly in the Middle East, have led to a further rise in gold and bitcoin. Increased expectations of lower US rates reinforced the rise in the gold price and, as we saw in July, a weaker dollar.

Table 4: Precious metals and currencies returns for July