It can't just be about Tech

- Financial Insights

- Market Insights

- The US tech sector shows powerful AI-driven growth

- Fed minutes keep bonds on hold at higher yield levels

- Global equities need better news from Europe and Asia to sustain the rally

- China contributes a little more to positive equity trend

- Asia ex-Japan will need the Chinese economy to show signs of solid stabilisation to progress

- Europe – hope builds for a recovery with help from the ECB

- Japanese equities – time for a breather?

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

It was a week of contrasts. NVIDIA’s market-beating results brought some good news from the world of AI, but they were contrasted with warnings from the Fed that the central bank is on a likely go-slow with respect to interest rate cuts. Meanwhile global equity investors search for further support for the rally from the rest of the world.

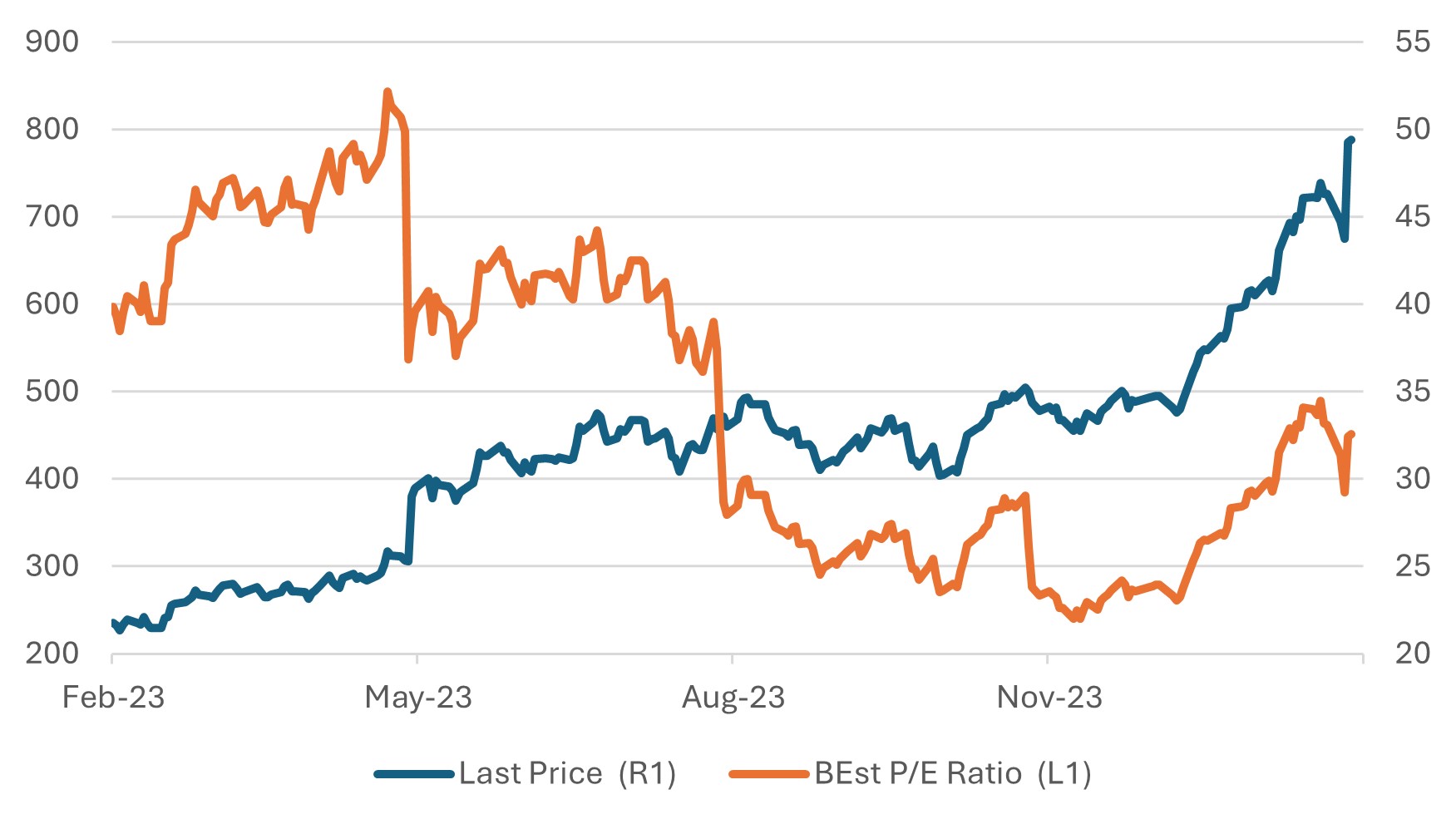

Our strategic asset allocation analysis conducted in the middle of last year highlighted the importance of incorporating a specific allocation to the technology sector within a global multi-asset portfolio. This approach aims to prevent the common investor tendency of undervaluing a sector that they often perceive as overpriced. The technology sector remains a significant contributor to the performance of the overall market index.

The landscape of the tech sector leadership has evolved, moving from the original FANGs to the “magnificent seven,” and now to the current “significant six,” with NVIDIA emerging as a particularly notable performer. Following recent financial disclosures, NVIDIA experienced significant upward revisions to revenue and profit expectations. For instance, Citi reaffirmed its “Buy” rating on NVIDIA, raising the price target on the stock to $820 from $575. Furthermore, the brokerage raised its EPS predictions for the fiscal years 2025 and 2026 by 58% and 75%, respectively, in anticipation of an accelerated growth in the AI market.

Chart 1: NVIDIA’s Impressive Performance, and Valuation

Source: Bloomberg

Fed signals its focus on inflation risk not growth risk

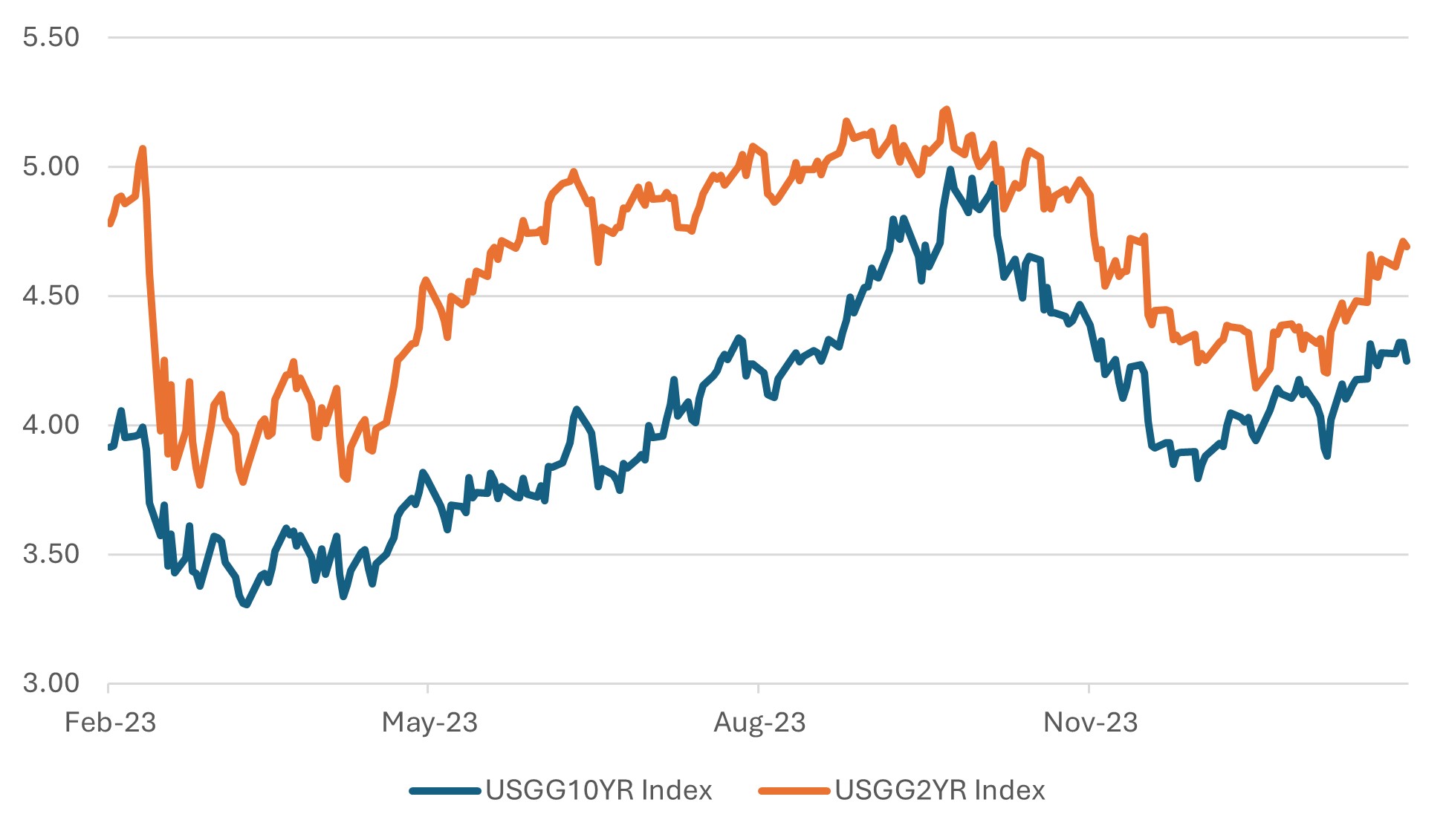

The minutes from the Federal Reserve’s recent meeting highlighted the central bank’s cautious approach towards lowering interest rates. Most of the central bank’s commentary was focused on the risks of cutting rates too early rather than believing that it was taking a risk with growth by not effecting a cut. With inflation data exceeding expectations in recent weeks, the possibility of a rate cut before June has significantly diminished. In response to these developments and the current market dynamics, market strategists have revised their bond yield forecasts upward by up to 20 basis points across various maturities. Current projections place the yield on the U.S. Government 10-year bonds near 4.0% for the majority of this year, with two-year bond yields expected to remain in the 4.65% to 4.85% range. These updated forecasts align more closely with the current yield levels.

The release of the US PCE data on Friday will put the focus back on inflation. The market expects a month-on-month increase of around 0.5% on the core PCE, equating to an approximately 3.0% year-on-year surge. Friday also sees the release of the February ISM manufacturing sector survey. The consensus is for an increase to around 50 level being a further small step up in confidence from the lows of the fourth quarter.

Chart 2: US 2-Year and 10-Year Bonds Re-Centred Around a Higher Yield

Source: Bloomberg

China contributes to the positive trend in markets

Despite the not-so-encouraging Fed minutes, the good news from NVIDIA has helped equity markets maintain their positivity. Of course, the market can’t just rely on the tech sector to always lift its fortunes. Nevertheless, what is also encouraging is that there has been some better news from parts of the world previously seen as struggling.

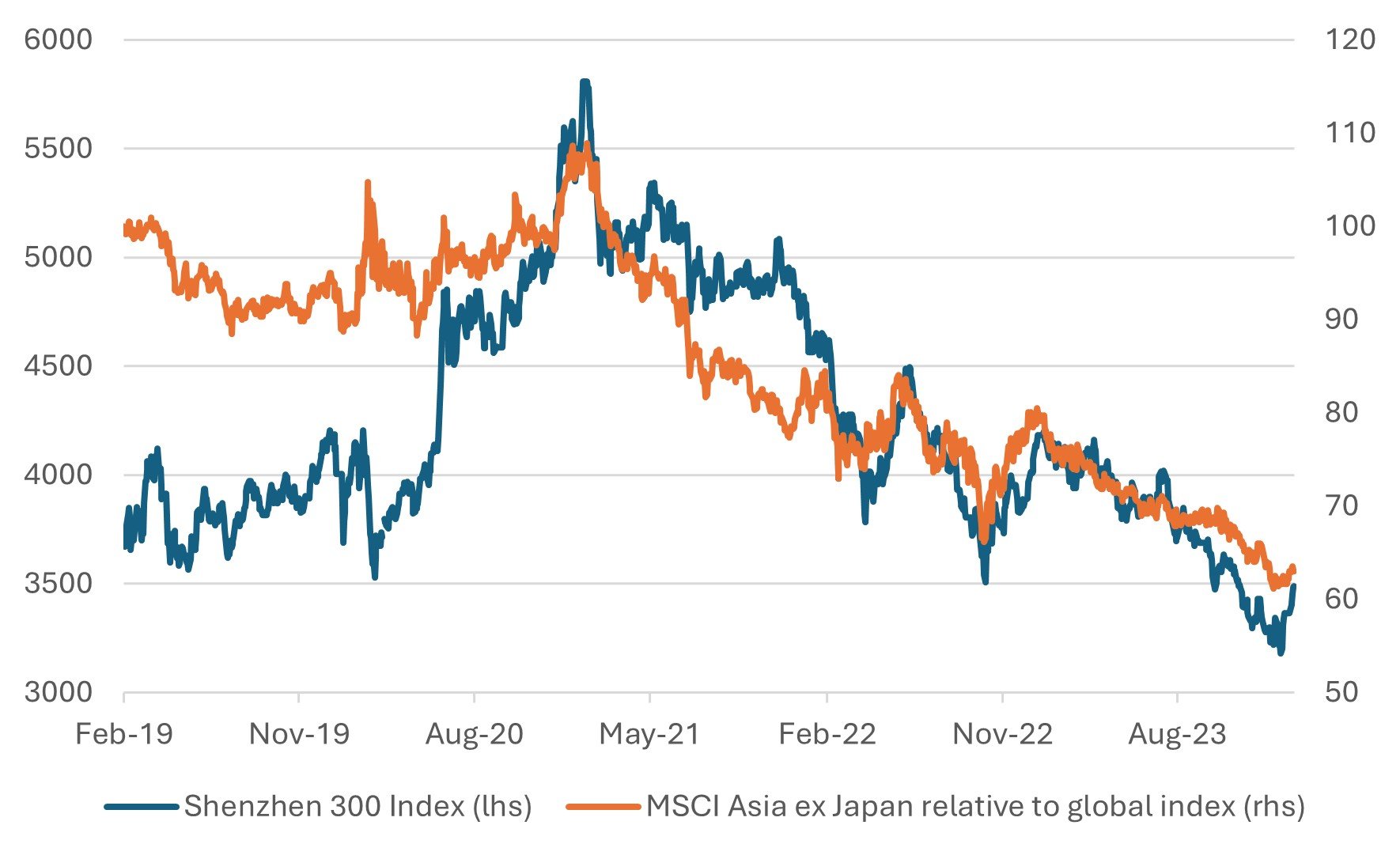

China, for instance, has helped lift the mood on the street with the government announcing a series of measures in recent weeks that give hope. Last week, PBOC, China’s central bank, surprised the market by cutting the five-year lending rate by a larger-than-expected 25 basis points. They also guided banks to cut the interest rates on existing mortgages. It’s clear that the measures are meant to provide some modest relief to the beleaguered real estate sector, rather than encouraging a further wave of speculative buying.

A stable China is crucial for market sentiment in the broader Asia ex-Japan group. Despite India’s strong performance in the index offsetting a good measure of the poor showing from China, the rest of the Asia ex-Japan index has struggled to perform. The Taiwan and Indonesia election cycle hasn’t helped either. In our view, it hasn’t just been a sentiment issue, but has more to do with the lackluster performance of the Chinese economy, which has weighed on the regional economy as well.

Chart 3: China’s Poor Performance has Dragged Down Asia ex-Japan

Source: Bloomberg

Europe – hope

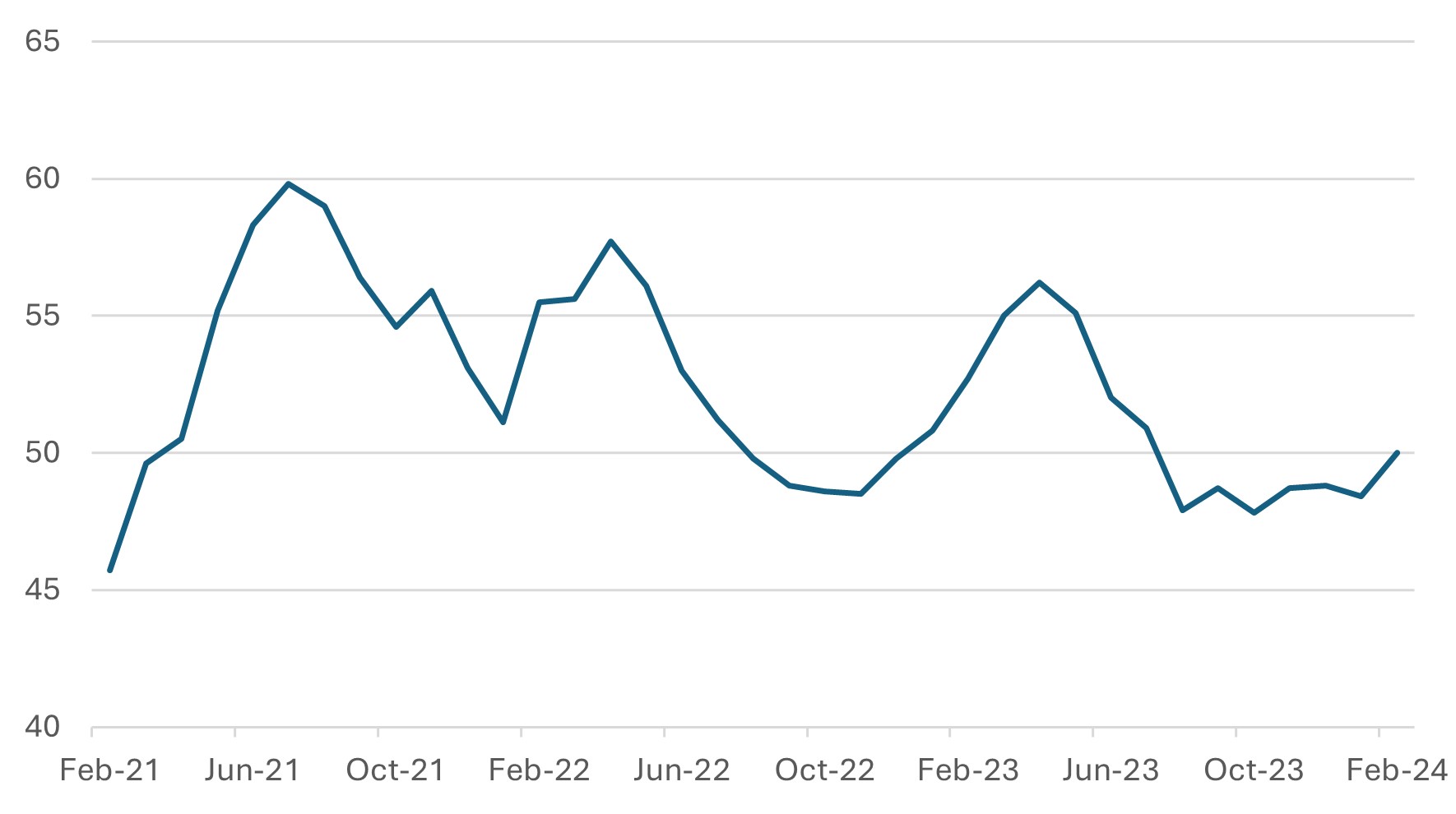

In Europe there’s an increasing hope that the region is beyond the worst and that growth can improve from here. Also, expectations have grown that the ECB will be cutting interest rates at around the same time as the Federal Reserve. Last week’s euro area industrial surveys showed that the manufacturing sector is still challenged but that the service sector is recovering at a faster pace than previously thought. The PMI for the services sector rose to 50.0 in February, up from 48.4 in January and ahead of expectations.

The German economy remains Europe’s weak spot. The Bundesbank last week cut its GDP forecast for the German economy to just 0.2% for 2024. Germany is facing some particular challenges after the German courts last year severely reduced the government’s scope to increase spending to support the economy. The hope for Germany and indeed the whole of Europe is that, an improvement in consumer confidence will unlock the large pool of savings that households accumulated in the Covid period that could eventually lead to a burst of consumer spending growth.

Chart 4: Eurozone PMI Shows Signs of Life

Source: Bloomberg

Japanese equities time for a breather?

The Japanese equity market has been a feature of the global markets since the start of the year with a 17% return in local currency and 10% in dollars. The next week might be a test for the near-term resilience of the market with a raft of economic data that is likely to show that the economy is still struggling for growth. The consensus has industrial production falling 6.8% in January month-on-month, -1.6% year-on-year. Housing start are expected to be down 7.8% year-on-year. Key data to watch out for are inflation and retail sales. The consensus expects inflation to fall back to +1.9% year-on-year, down from 2.6%. This should be helpful to trends in consumer spending growth as lower inflation leads to stronger real income growth and spending power. Retail sales growth for January is expected to +2% year-on-year down from 2.3% in December.

Chart 5: Nikkei 225 makes new highs – time for a breather?

Source: Bloomberg