Challenges of Higher for Longer

- Market Insights

- Financial Insights

- Challenges of higher for lower sees repricing of assets

- US 10 year government bond yield in a new trading range

- Dollar strength a challenge for EM policy makers

- US smaller cap sentiment at 11 year low

- Spring World Bank and IMF meetings focused on the right issues?

Markets continued their slide last week amidst prevailing interest rate angst and geopolitical uncertainties. US equities ended the week 4% lower while US 10-year bond yields inched up 11bps.

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

A few trends are developing

We see a new trading range for the US 10 year of 4.25%-4.75%. The investor hopes for US government bond yields tracking down to the 3.0%-4.0% range look unlikely to be realised soon. We are now in a territory where we literally have a break from 15 years of successive low interest rates. The market prices a rate cut some time between September and November. Hence, by the end of the year we could still be seeing interest rates of more than 5.0%.

Chart 1: US 10-year Government Bond Yield in a New Trading Range

Source: Bloomberg

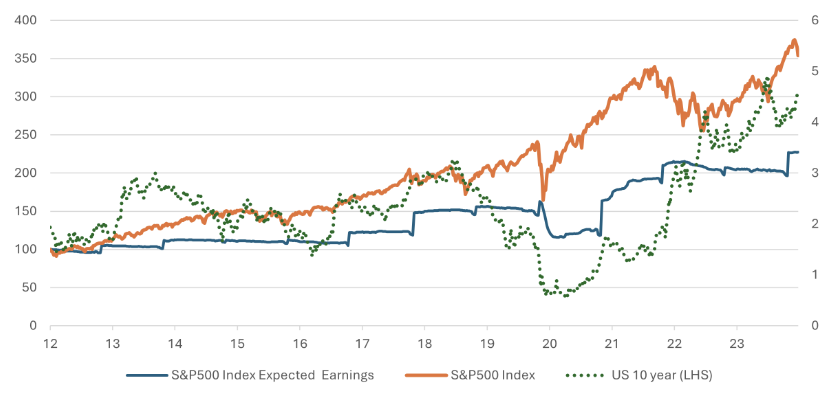

US equities must have downside risk when trend growth in the market index is so way ahead of earnings and the discount rate (the US 10-year yield) is almost twice the average of the past 12 years. P/E multiples typically fall when long-term interest rates rise. Some market participants may still be of the view that sometime in the next 12 months the yields on the 10-year government bonds will decrease. But with inflation remaining a problem and hopes for rate cuts almost in abeyance, the risk is of a lower equity market P/E multiple.

Chart 2: Equity Market Index Way Ahead of Corporate Earnings Growth and the Challenge of Markedly Higher US 10-year Yield

Source: Bloomberg

As we had suspected, emerging market assets have struggled, but it’s far from being a crisis. The weakness in EM currencies has, however, caused their respective central banks to scramble to stabilise the situation. Last week, the Mexican peso, which declined by 2.6%, and the Indonesian rupiah, which fell 2.5%, were the standout EM currency moves.

EM dollar bond markets remained under pressure during the week. Among the EM dollar-denominated bonds, Indonesia’s yields rose 13 bps to 5.28% (for a cumulative one-month rise of 39bps), the Philippines’ rose eight bps to 5.39% (35bps), Panama’s 23 bps to 5.41% (50bps), Colombia six bps to 7.69% (52bps), and Brazil three bps to 6.73% (25bps). Over the past month, local currency bond yields have risen by 116 bps in Turkey, 66 bps in Colombia, 61 bps in Brazil, and 58 bps in Mexico.

There’s scope for more profit-taking in the coming sessions, given that EM debt spreads are narrower now. However, despite the (modest) sell-off, these are still some of the lowest spreads since 2007. Moreover, we do not see this as an emerging structural challenge to EM debt, particularly given that global growth continues to impress. We would target the sell-off to lead to spreads widening to where we started the year, i.e., the 320bps level, which is 35bps higher than Friday’s close.

Chart 3: EMBI Bond Index spread

Source: Bloomberg

Small caps’ higher-for-longer pain

We had hoped that the next phase of the US equity market progress would rotate into the small caps. However, the current scenario of higher-for-longer interest rates could particularly weigh heavily on smaller companies, in our view.

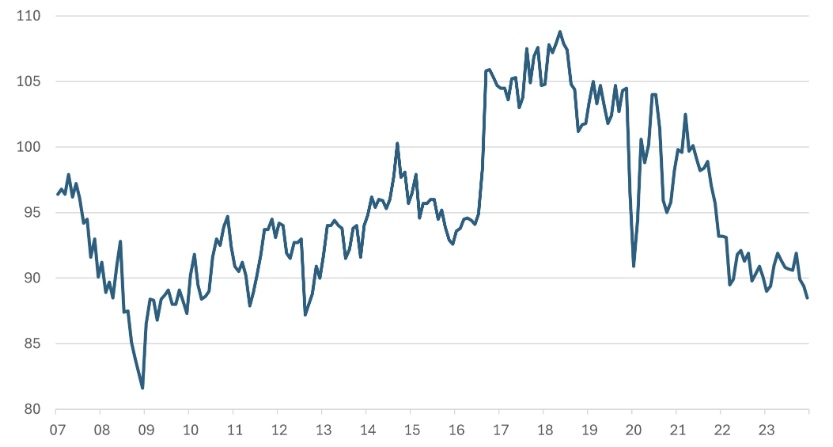

We will be looking at how the prospect of higher-for-longer US rates will pressure the economy in the coming months. There are signs of stress already visible in some interest rate-sensitive sectors of the economy. Small companies are typically more leveraged than the larger ones. In fact, the NFIB survey of small companies is at its lowest level in 11 years. Capital expenditure plans, too, are at the lowest level since the COVID crisis.

Chart 4: NFIB Index Shows Weakness in Small Companies’ Sentiment

Source: Bloomberg

The weakness in the macro indicators concerning the small caps sector provides an argument as to why we probably won’t see a recovery in the Russell 2000 index of small companies anytime soon. The index now stands at its lowest level relative to the S&P500 index since 2001.

Chart 5: Russell 2000 Index Relative to S&P500 (rebased to April 2017=100)

Source: Bloomberg

Spring Meetings Focus: World Bank and IMF Urged to Address Critical Global Issues

As the World Bank and IMF commence their Spring meetings, a compelling perspective shared by Larry Summers and N.K. Singh in their Project-Syndicate article, “The World is Still on Fire,” captures our attention. They highlight four critical areas that these esteemed institutions must urgently address to stabilize the global landscape:

- Enhancing Support for Low-Income Countries: It’s vital to reverse the capital flows to ensure that low-income countries receive more financial support than what they pay out to private creditors. Our own experiences in securing funding for frontier countries have revealed a significant disconnect between the language and priorities of major corporations and first-world banks, and the pressing developmental needs of the emerging world.

- Reforming Multilateral Development Banks: These banks should transform into bold, risk-taking entities with a focus on climate issues. The finance industry’s current fixation on solely financial returns overlooks the need for transparent, substantial investments in projects addressing serious environmental challenges. While many banks are quick to discuss their AI strategies, the discussion rarely extends to the increased carbon emissions these technologies may entail.

- Securing Funding for the International Development Association: Full funding for this association is crucial to support its ongoing efforts in the most vulnerable regions.

- Addressing Global Food Security: The twin challenges of the Global Financial Crisis and COVID-19, compounded by a rise in nationalism, have led to reduced resources for tackling food insecurity in low-income countries.

These last two points underline the necessity for developed nations to commit adequate resources towards supporting the world’s most vulnerable populations. The discussions and outcomes of the current World Bank and IMF meetings could be pivotal in directing future global economic stability and growth.