Don't get Anchored on the Wrong Past

- Market Insights

- Financial Insights

- It would be a mistake to believe that bond yields will revert back to the average of the last decade

- Instead we see fair value for the US 10 year bond yield at 4-5% into the medium term

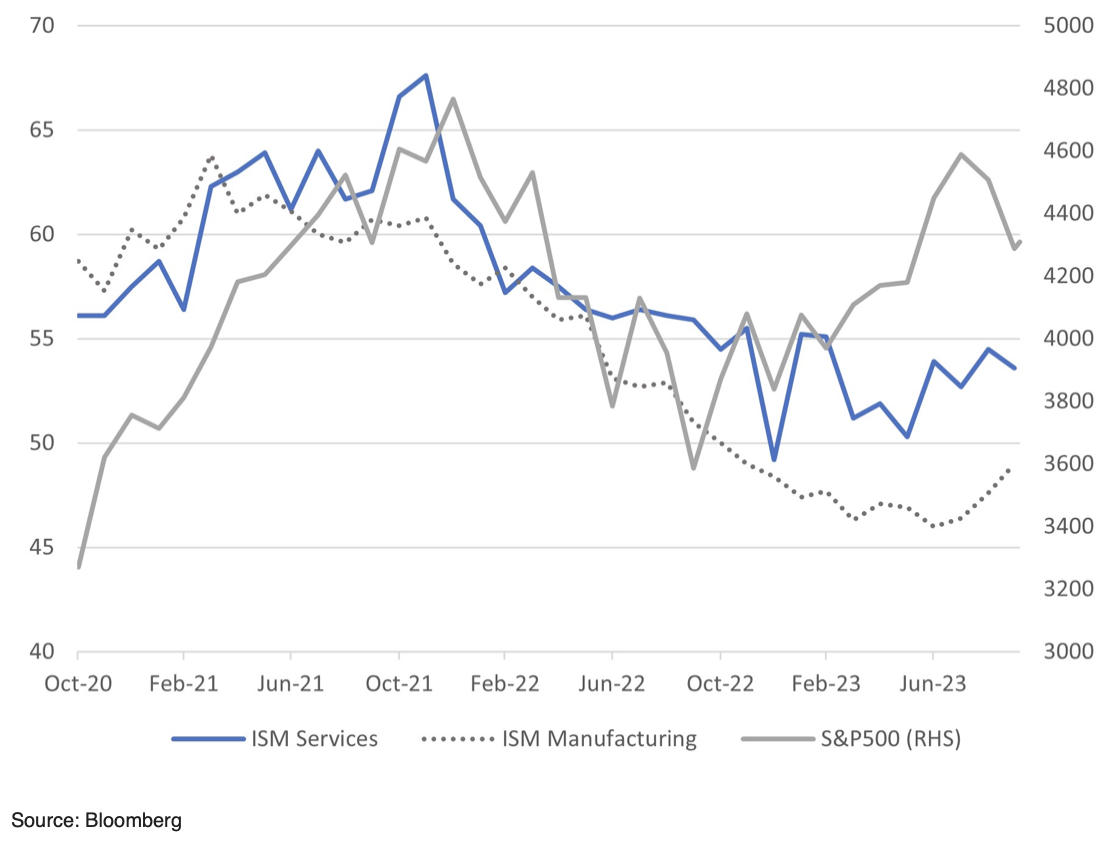

- Spike higher in US industrial confidence argues for a rebound in equities through the US corporate results season

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

In times such as these, investors need help in gauging the true value of the markets. For them, one of the toughest calls to take is estimating the fair value of the US 10-year government bond yield. In the past five years, the US 10-year government bond yield has ranged between as low as 0.51% and (very recently) as high as 4.8%. The task therefore is not easy.

The key to making judgments about the future of equities or, indeed, any asset class is where one believes short- and long-term interest rates will average, i.e., what shape the upcoming interest rate cycle is going to take? There are a number of elements to arriving at a decision about where interest rates will trade in the future, such as:

- Gauging where one believes inflation will land,

- Understanding how the central banks will react to that level of average inflation, and

- Estimating the risk premium the markets would demand for investing in longer-dated bonds such as the US 10-year government bond.

Investors tend to build their hopes and fears for the future on recent experience. Only in the past two years have we broken the investor and policymaker mentality that the most significant risk to the global economy was one of deflation. Ever since the global financial crisis, central bankers have consistently maintained accommodating policies. They held short-term policy rates below the level of inflation while manipulating the long-term interest rates lower through quantitative easing.

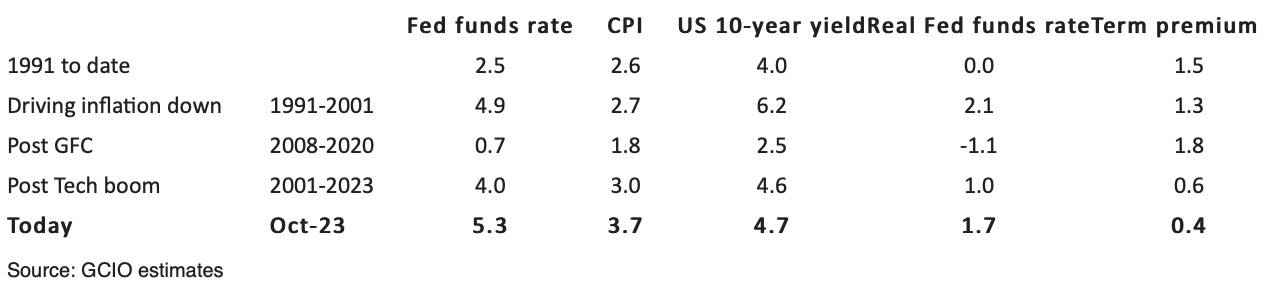

Hence, looked at through the lens of the past 20 years, the Fed funds rate would revert closer to zero, real policy rates would be negative (-1.1%), and the US 10-year would be anchored closer to the average since the GFC of 2.5% (see table 1).

Table 1: Average interest rates, inflation and bond term premiums since 1991

Anchoring views on recent experience is called heuristic behaviour. Several studies have been conducted attempting to measure the biases that can influence how we look at data. For instance, just take the most recent two years when the Fed kept assuming that inflation would gradually ease, partly because it anchored that view on the past when its battle was with very low inflation. However, to realign its thinking quickly and anchor its views not on the past but on recent outcomes, the Fed needed to be timelier in tightening the monetary policy. A lack of timely action on the Fed’s part only exacerbated the inflation problem, leading to a need for even higher interest rates than would have been the case had the Fed made a timely move.

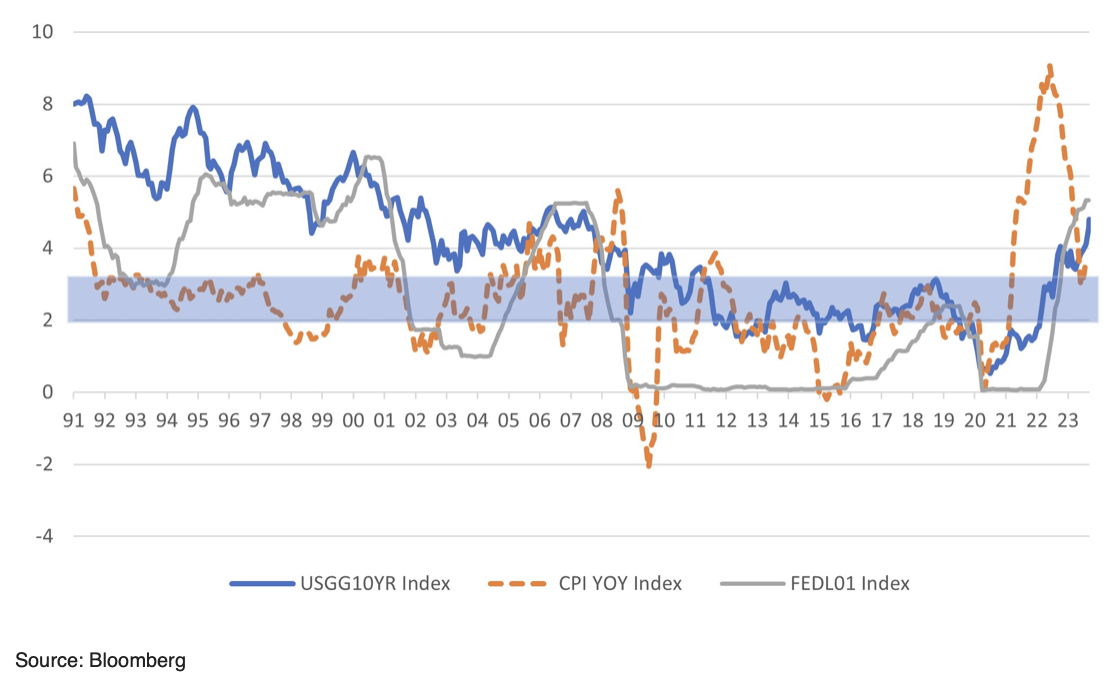

Analysing the monetary policy trajectory since 1991, we see that interest rates are substantially higher today than they have been on average since 1991. Inflation too is well above the average seen during this period. It then begs the questions as to why the 10-year bond yield is not already substantially higher. Today’s term premium for the US 10-year at 40bps looks too low. The average of most periods has been well above 100bps.

As we analyse the scenario that is unfolding today, we need to go back a bit in time. From 1991 to 2001 the Fed was actively driving down inflation. Over that period, the US 10-year yield averaged 6.2% while inflation averaged (just) 2.7%. Part of the reason for the higher long-term interest rates back then was that the Fed had only just begun building its credibility in beating down inflation. Investors also had an inflation mindset. Cut to today and investors have the benefit of anchoring their views on the dark days of the COVID-19 pandemic and the low inflation in the wake of the global financial crisis.

So, pulling all the numbers together, we think it is instructive to look at the period from 1991 to 2004. For a significant part of this period, inflation stayed in a band of 2-3%. Through this time, the Fed funds rate quite often strayed beyond 5% to keep inflation under control. However, we also acknowledge that in the 1990s the US had the greater potential to register good nominal growth because the potential growth of the economy was higher than where it finds itself today. If we take a percentage point off the potential growth, and maintain the same inflation range we solve for a US 10-year bond yield that should ordinarily be in the 4-5% range.

Chart 1: US 10-year bond yield, Fed funds rate and US CPI (%)

The shaded area marks 2-3%

In the very near term the bias for risk is for higher US bond yields that possibly push through the 4-5% band. It is far from clear when the US Fed funds rates will peak with an economy that has, at least to date, not rolled over into a recession that many had been forecasting until recently.

There are two key events for the US bond market this week. Firstly, we have the US consumer inflation data. The consensus is that the September CPI report will show a month-on-month headline increase of 0.3%, decreasing the headline rate to 3.6% from 3.7%. Similarly, the consensus is that core inflation will retreat to 4.1% from 4.3%. However, if there is a bias for any risk, it is that the inflation numbers will surge past expectations. With energy prices running hot and the economy remaining on a strong footing, there is indeed a risk of higher inflation. Second in the series of events this week is the US Treasury auction of 10- and 30-year bonds. The past two 30-year auctions in August and mid-September were followed by a sharp rise in the 30-year rate in the subsequent days.

It is noticeable that credit has finally started to succumb to the bearishness in the bond market. US high yield, even adjusting for the asset class having around half the duration of US Treasuries, has performed well as the extra yield has compensated for the rise in Treasury yields. High yield spreads are now at the average of the year, but we suspect they will move higher through the balance of the year.

US equities into the results season. It will be fascinating to hear what US corporate have to say about their assessment of the economy as we move into the third-quarter results season. The US equity markets starts in earnest this week. Focus will also be on the banks that will be reporting numbers. Dow Jones reports that “JPMorgan Chase & Co. (JPM) will kick off the banking industry’s third-quarter earnings season on Oct. 13 before the market open, with Citigroup Inc. (C) and Wells Fargo & Co. (WFC) also reporting that day. Bank of America Corp. (BAC) and Goldman Sachs Group Inc. (GS) will report on Oct. 17, and Morgan Stanley (MS) will round out the “big six” U.S. banks with its third-quarter earnings announcement on Oct. 18.

Maybe part of the reason why the equity markets held up relatively well last week was the hope that the results season will give some good news, in line with the better tone emerging from the industrial confidence surveys in recent weeks.

Chart 2: US Industrial confidence surveys supportive of the equity market