Invest with Impact Towards a Sustainable Future

We provide a digital platform for curated green, social, and sustainable investments that go through a risk-based ESG framework by our in-house team of ESG professionals.

Convenor for Sustainable Finance

SDAX is a meeting point for issuers and investors who seek to balance their investment portfolio towards making a difference to our society and environment.

SDAX Sustainability

<span data-metadata=""><span data-buffer="">Education and Insights

Learn what sustainable finance and investing are about from SDAX’s ESG team.

Sustainable Financing

For issuers whom are in sustainable initiatives looking for funding, we would like to speak to you!

Sustainable Investments

Access a range of ESG investments that go through a proprietary risk-based ESG framework stewarded by our in-house qualified professionals.

Why invest in ESG?

"Who Cares Wins"

Towards a Net-Zero World

Beyond Financial Returns

Sustainable investing is looking beyond financial returns. Investors can put their capital to work in a way that reflects their values, that make a contribution to the things they consider important and that positively influences society so that we move towards a more sustainable future.

Sectors in Sustainability that we work with

How You can Start

Register

Register an account with your information online

Verify

Verify your account by uploading documents

Fund

Transfer funds to your fiat wallet by bank transfer

Invest/Trade

Start investing or trading curated opportunities

Are You Ready for Liberation?

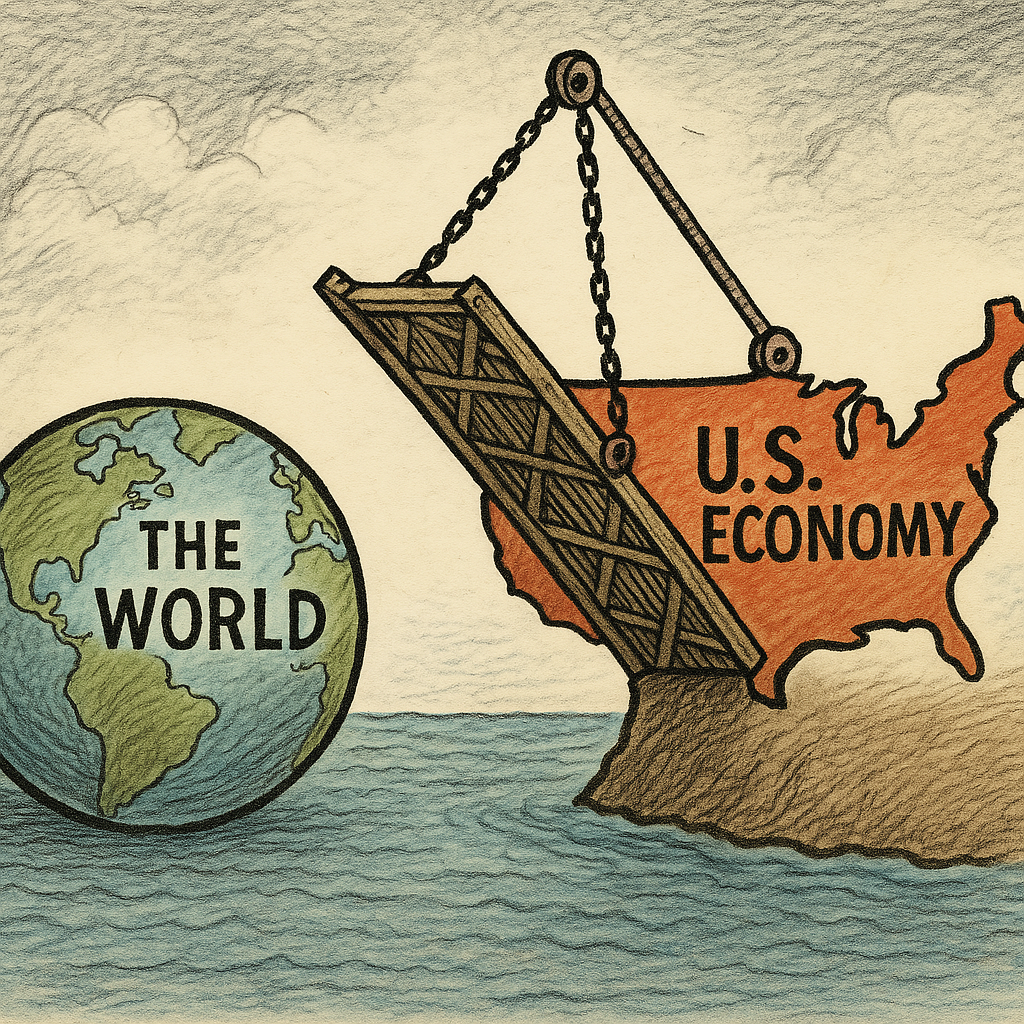

Twenty-five years after the dot-com crash, current market conditions bear striking resemblance to historical inflection points. A confluence of factors, including escalating geopolitical tensions, unpredictable trade policies, and mounting stagflationary pressures, has created an increasingly complex landscape for investment decision-making.

India’s Stock Surge Leads Market Rotation

Markets experienced a subtle shift last week as investors rotated capital away from recent outperformers. US equities edged higher, with the S&P 500 up 0.5%, supported by a strong “buy-the-dip” mentality – Bank of America reported the third-largest equity inflow since 2012. However, technical indicators remain weak, with the index still below its 200-day moving average and earnings estimates for Q1 2025 continuing to decline.

Focus on What is Important

Amid the unpredictability of U.S. policymaking, investors are adapting to the noise, as evidenced by declining equity volatility. Investors shouldn’t lose sight of what truly matters: growth, inflation, and the dollar.

US growth is under pressure, with 2025 GDP forecasts sliding. Estimates now range between 1% and 2.2%, with major institutions like Goldman Sachs and Vanguard revising their projections downward. Rising trade tensions, financial tightening, and weakening labor market conditions are key concerns that could further dampen economic momentum.

Inflation remains a looming risk. While recent data has been stable, consumer expectations tell a different story. The latest University of Michigan survey shows households now anticipate inflation at 4.9% in 2025—nearly double earlier projections. Tariff uncertainty and broader economic concerns are fueling these fears, signaling potential turbulence ahead.

The US dollar could become a wild card under a second Trump administration. Key advisors have previously supported policies to weaken the dollar in an effort to boost exports. However, a deliberate devaluation could trigger inflationary pressures, increase import costs, and even challenge the dollar’s status as the world’s primary reserve currency.

With so much noise in the markets, investors should remain geographically diversified and consider holding gold as a hedge. And as sentiment shifts, perhaps it’s time for a different kind of debate – one that asks whether Starbucks is a better investment than Nvidia.

The Bybit Hack and The Structural Fix Cryptocurrency and Digital Asset Exchanges Need

The recent breach of the Bybit cryptocurrency exchange, resulting in the theft of a staggering US$1.5 billion in user assets in February 2025, is yet another stark reminder of the systemic vulnerabilities plaguing the cryptocurrency and digital asset industry. This incident follows the storied history of other high-profile exchange hacks, including Binance (US$570 million in October 2022), FTX (US$600 million in November 2022), and the Ronin Network (US$615 million in March 2022). Even Mt. Gox, once a dominant player, was driven to liquidation after losing US$473 million in its final breach.

SDAX 2025 Outlook Report

For years, SDAX has been committed to serving as a trusted resource for investors navigating the complexities of the global market. In collaboration with The Global CIO Office, we deliver in-depth analysis and expert perspectives on the trends shaping the financial landscape, empowering you to confidently identify and capitalise on evolving opportunities and risks across asset classes.