- Market Insights

- Gold

Gold as Part of a Portfolio

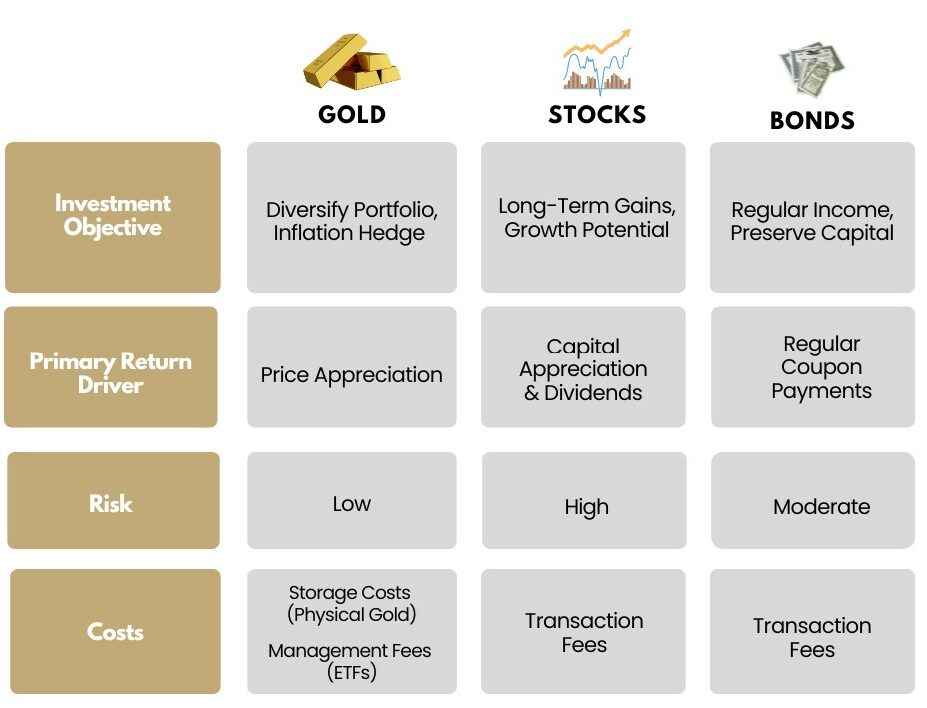

The construction of a well-rounded investment portfolio requires diligent diversification. When contemplating the asset allocation between traditional assets like stocks and bonds and including alternative assets such as private market instruments and gold, it is key to assess the nuances of each asset’s distinct characteristics, risks, and potential returns, and how they fit into one’s risk tolerance and financial goals.

Comparing Gold vs Stocks & Bonds

-

1. Stocks: Epitome of Growth and RiskStocks, which provide ownership in publicly traded companies, offer investors a share of corporate profits and potential capital appreciation. Investors include stocks in their portfolio, through individual stocks, mutual funds, or index exchange traded funds (ETFs), in the expectation of long-term growth and wealth creation.

-

This expectation of growth is however accompanied by intrinsic risks of the stock market. Stock prices are often subject to market volatility and company-specific factors, including company performance, industry trends, legislative and regulatory changes, macroeconomic factors, and geopolitical events. (Source: Fidelity)

-

2. Bonds: Fixed Income StabilityBonds represent debt instruments issued by governments, corporations, and other entities. In contrast to growth driven nature of stocks, bonds offer a stable fixed income profile, as investors receive periodic interest coupons and return of capital at maturity.

-

Bonds are often perceived as a stable, less risky investment compared to stocks. This perception has however been subjected to challenges recently in high inflationary environments where bond markets have not been their usual safe harbour for investors. Bond returns have been more erratic and occasionally negative amid heightened volatility. Changes in interest rates affect bond prices and bonds are essentially subject to the risk of default and dependence on the creditworthiness of the borrower.

-

3. Gold: A Safe HavenGold is a tangible commodity with a finite supply and has intrinsic enduring value as a precious metal that has persisted across millennia. These inherent qualities of gold make it a safe haven. It has provided investors refuge from market turbulence during periods of economic uncertainty and global turmoil. Gold is generally uncorrelated to stock and bond markets. (Source: World Gold Council)

-

Gold’s appeal comes however, with its own challenges. Whilst it offers sanctuary against systemic risks and is a store of value, it does not provide income generation. Gold does not pay dividends or interest coupons; it is primarily a vehicle for capital appreciation. Gold prices are influenced by factors such as supply and demand dynamics, geopolitical events, and market sentiment, albeit in a different manner that stocks and bonds are.

Final Thoughts

Diligent diversification is imperative in the construction of a balanced portfolio. In considering the range of investment instruments available against one’s risk tolerance and investment horizon, stocks offer growth and bonds provide stable fixed income, but both are subject to risks of volatility, company performance, creditworthiness, and macroeconomic movements. Gold provides additional risk mitigation with low correlation to stocks and bonds, serving as a hedge against economic uncertainty and inflation, and an enduring store of value.

For those interested to include gold as part of their portfolios, Gold Tokens are now listed on the SDAX Exchange. These Gold Tokens are securitised, issued by an independent trust and backed by physical gold bullion held at Freeport vaults in Singapore.

Visit https://www.sdax.co/gold/ to find out more.