An Exclusive Opportunity

Invest in our gold-backed loan notes to receive double-digit returns

Start investing from S$10,000 or USD$10,000 today

Why Invest in Gold

The allure of gold as an investment asset is rooted in its intrinsic scarcity.

In the face of global uncertainty, gold provides investors with a safe haven asset, a reliable store of value as a hedge against inflation and a tool for portfolio diversification.

Safe Haven Asset

Inflation Hedge

Diversification

Tangible Asset

Gold as Part of a Portfolio

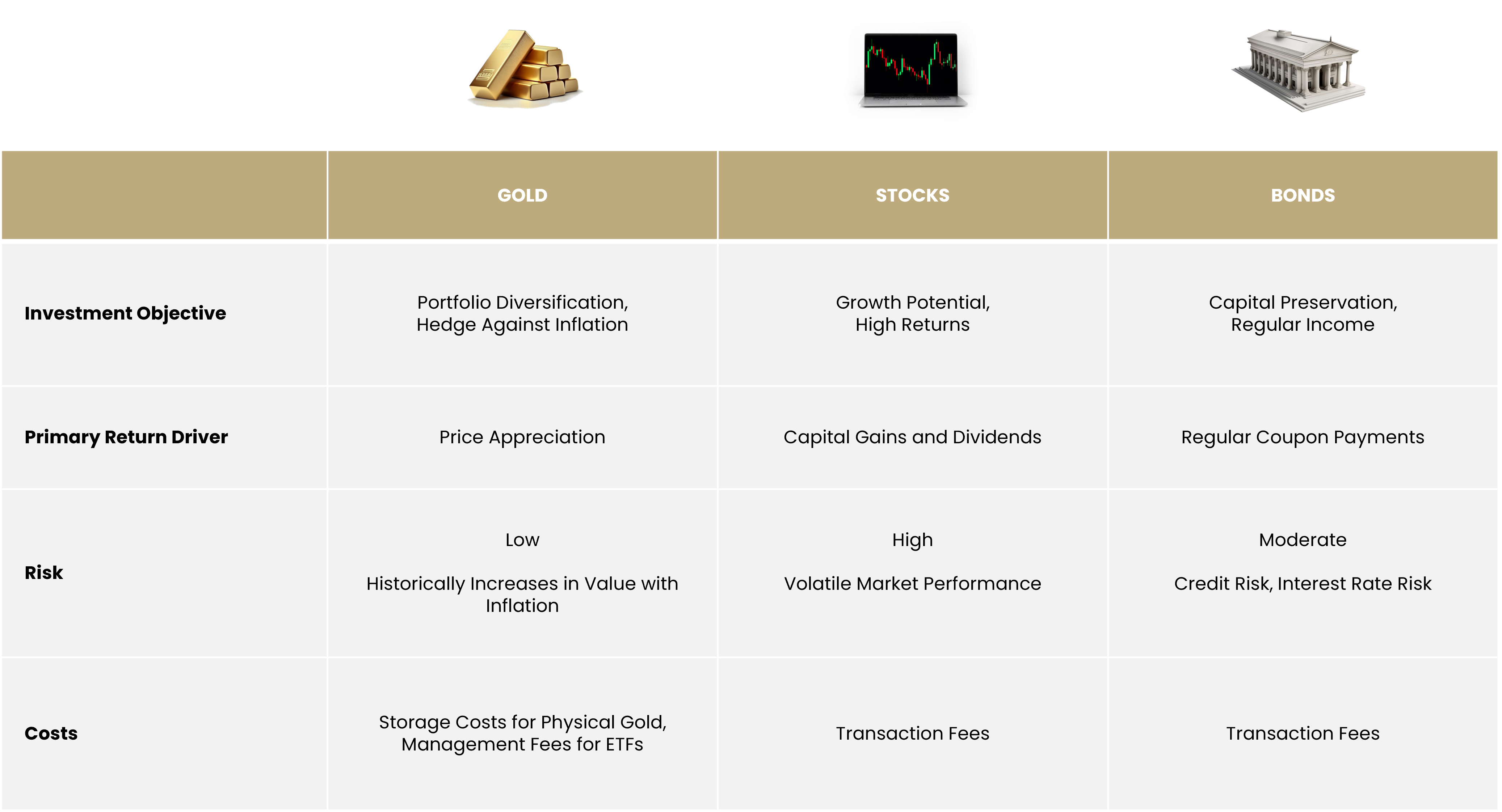

The construction of a well-rounded investment portfolio requires diligent diversification. When contemplating between traditional assets (stocks and bonds), as well as private market instruments and gold, it is key to assess the nuances of each asset’s distinct characteristics, risks, and potential returns, as well as how they fit into one’s risk tolerance and financial goals.

Different Ways to Invest in Gold

How to Invest in Gold

Investing in gold offers a wide range of benefits for a well-rounded portfolio. Whether its through physical gold, digital gold, or gold-related ETFs and stocks, each of these avenues suit a range of preferences, risk tolerance, and investment objectives.

Physical Gold

Gold ETFs

Gold Certificates

Gold-Mining Stocks

Futures & Options

Gold Crypto Tokens

A New Way of Investing

For those interested to include gold as part of their portfolios, Gold Tokens are now listed on the SDAX Exchange.

SDAX Gold Tokens are:

Fractionalised (by Troy Ounces)

Securitised

Issued by an independent trust

Backed by physical gold bullion held at Freeport vaults in Singapore

A Brief History of Gold

The Legacy of Gold

Gold’s allure dates back to the earliest human civilisations, where its rarity, durability and beauty set it apart from other materials.

Beyond the cultural and religious significance and ornamental applications, gold was used as a medium of exchange and store of value. The earliest use of gold as currency dates back to the Lydians in 6th century BCE who minted the first gold coins.

Birth of the Gold Standard

As trade routes flourished, gold facilitated the exchange of goods and services across nations as the preferred form of transaction currency. This set the foundation of the gold standard.

The gold standard emerged and rose to prominence in the 19th and 20th centuries as a monetary system with the aim of providing stability and facilitating international trade and foster economic growth.

Gold Standard's Untimely Demise

The gold standard however was not without its challenges, as it constrained policymakers’ abilities to respond to economic conditions and gold supply fluctuations could lead to deflationary pressures.

The outbreak of the two world wars and the Great Depression ultimately led to its final demise in the 1970s.

Gold as an Investment Asset

Even as the gold standard for the international monetary system has been abandoned for a system based on pure fiat money, gold has persisted as a significant reserve asset for most central banks.

Against the backdrop of economic and geopolitical uncertainty, gold has stood the test of time and remains still, a safe haven asset and diversification tool for investors seeking to mitigate risk and preserve their wealth.

As we contemplate the golden thread that has woven its iridescence through history, gold’s enduring role as a store of value and an investment asset continues to be critically relevant in today’s economic environment.

Interested to find out more about gold?

Create an account with us now to keep updated on our latest newsletters and events.