A US rate rise? Possibly, but not Probably

- Financial Insights

- Market Insights

- US inflation data worries increase

- Economist sage Larry Summers urges us not to rule out a rate rise

- US 10- year bond yield in value territory

- UK equities get help from the better-than-expected retail sales, but only after a recession in Q4

- Nikkei within striking distance of its all-time 34-year high – we retain our positive view

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The recent inflation news flow has put the market on the backfoot. As we have discussed in our newsletters over the past three weeks, an ongoing period of disinflation has ended, although the market prefers not to admit it. The story of more inflation than the markets bargained for goes back a few weeks to the USM ISM service sector prices paid index, which showed the most significant monthly increase since 2012. Such a surge is remarkable. However, to convince the market that the phase of disinflation is truly in abeyance, we have considered a few more inflation data points. The economic data reports over the past few weeks have shown inflation hardening at around 3-4% and remaining uncomfortably above central bank targets.

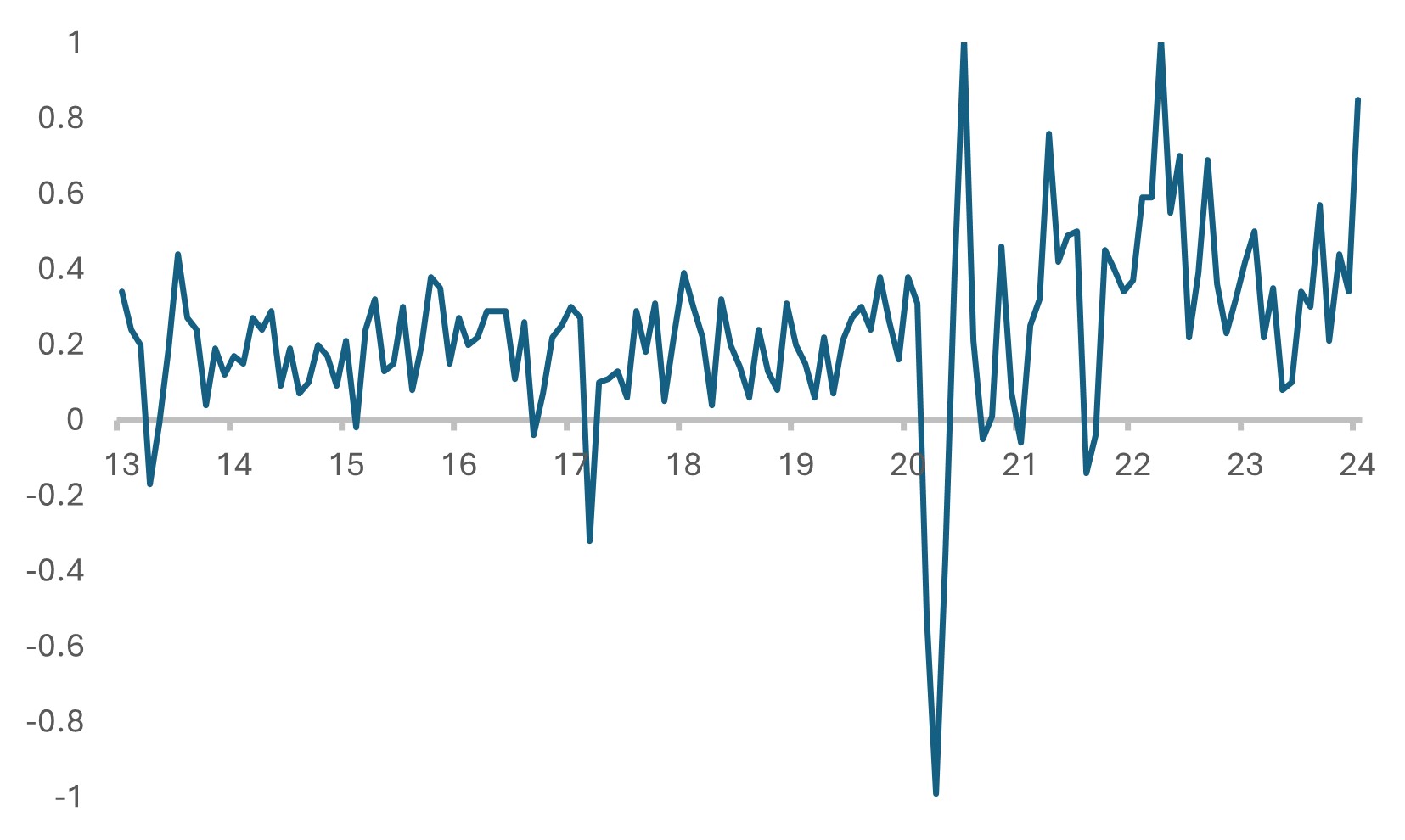

Chart 1: US ‘Super Core’ Inflation Month-on-Month – One of the Highest Readings

Source: Bloomberg

Could the Fed raise rates? Possibly but not probably

While we’ve previously hinted—though not as explicitly as former US Treasury Secretary Larry Summers did last week—there exists a small yet noteworthy possibility of a rate hike in the US. Summers estimates this probability at 15%. In our view, engaging in a robust discussion about the risks of a rate hike could help temper expectations regarding the speed of potential rate cuts. In Summers’ words, January witnessed “explosive supercore” inflation, with a month-on-month increase of 0.8%, one of the largest monthly spikes in decades.

It’s important to remember that curbing inflation has historically been a challenging endeavour. Companies often adopt an inflationary mindset, leading to near-automatic yearly price hikes. Only intense competition or significant consumer pushback tends to push firms to lower prices or postpone increases. The last major inflationary period prompted several businesses to raise prices, which was a diversion from their traditional strategy of price reductions to capture market share in a sluggish economy.

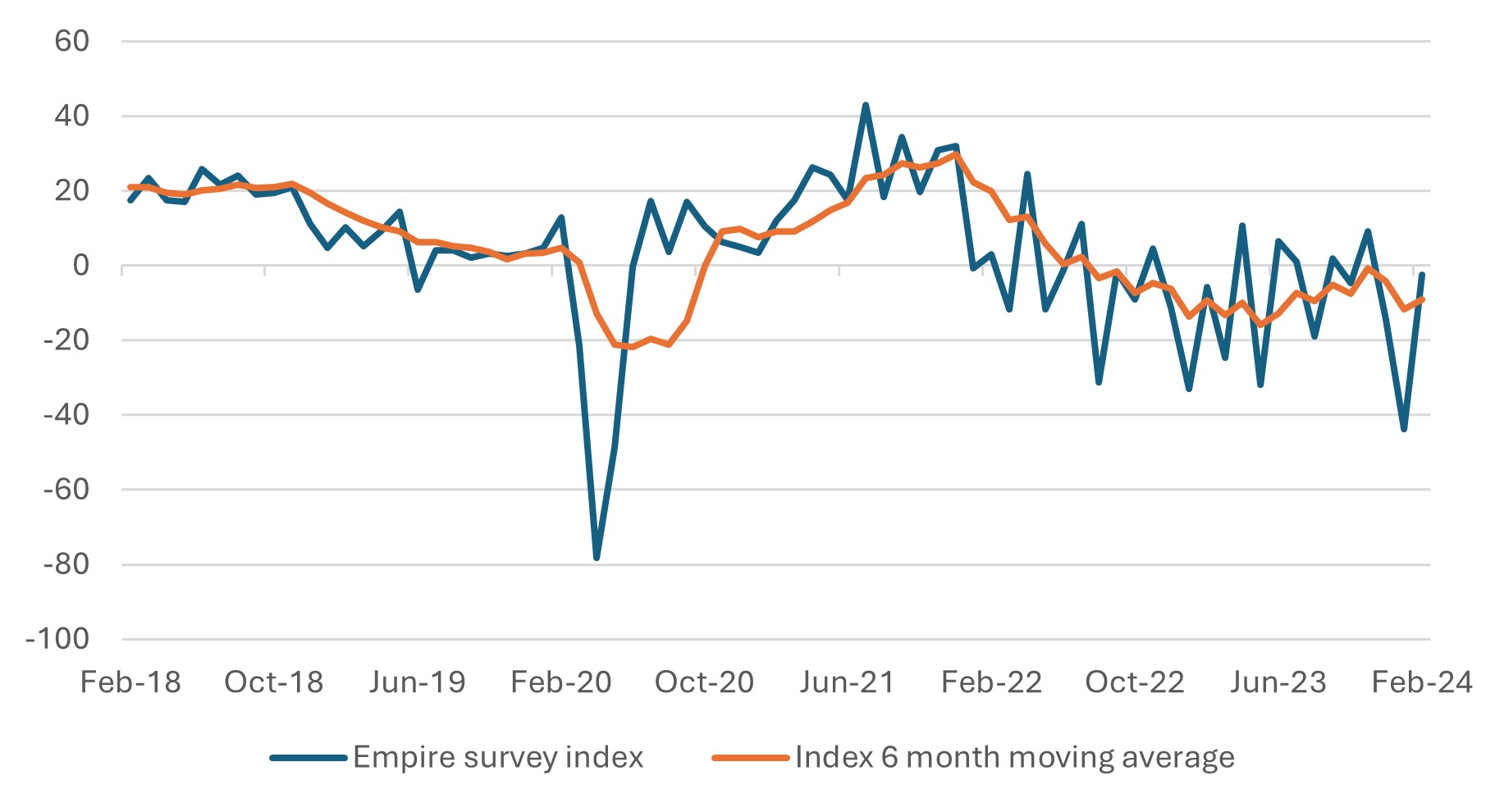

Our current assessment suggests that June could be the most probable window for a US rate cut. However, this forecast hinges on two critical conditions: a softening in inflation rates and a slight downturn in the job market. Economists are currently grappling with the uncertainty surrounding the actual pace of economic growth, as suggested by recent data releases. Up until a point, indicators were signalling a GDP growth rate for the quarter, annualizing at approximately 3.5%. Yet, the latest economic figures, particularly concerning US retail sales and industrial production, have shown weakness, partly attributed to adverse weather conditions in January. It’s noteworthy that even official sources acknowledged the potential negative impact of the inclement weather on these figures. Despite this, survey data has shown resilience, with the recent New York area survey bouncing back from a significant low in January to levels above the trend (Chart 2).

Chart 2: US Empire State Survey of Business Confidence Shows a Sharp Rebound from the January Low

Source: Bloomberg

The trend in the US 10-year bond yield is instructive. From its December 27 low, with some volatility, the yield has been trending higher. The stickiness of inflation is quite apparent to the market. Also, the much-reduced market expectation of a March rate cut has taken its toll on the yield curve. We believe that a yield of 4.0% is around fair value for the US 10 year.

Chart 3: US 10-year Government Bond Yield Trending Higher since December

Source: Bloomberg

The UK economy and market sees some momentum

Last week, we commented that the UK equity market seemed to be discounting the bad news and could be due for a rebound. Eventually, the UK market did receive some bad news from the past and some good news in terms of recent economic momentum. Q4 GDP growth, for instance, showed that the economy was in recession in the fourth quarter. However, January retail sales were stronger than expected, double the market expectations at +3.1%. The market ended the week with one of the stronger performances amongst the Western developed markets, up 1.8%. Banks led the way with NatWest surging 10% and HSBC gaining 5%.

Japanese equities on a roll

It is a sign of the times that the Japanese equity market can have a great week with a 4.4% return despite bad economic news. Japan’s third-quarter GDP was weaker than expected and it lost its spot as the third-largest economy in the world to Germany. The economy contracted for the second quarter in a row by 0.4% compared with economists’ expectations of a 1.1% expansion. Investors recognised that weak consumption was largely responsible for the economy’s dismal performance. In coming quarters economists expect a good measure of wage growth to encourage stronger consumer spending.

The Nikkei (38487), after last week’s strong performance, is a whisker away from its all-time-high of 38,915. We remain positive and expect more from the market – after all, there is a missing 34 years to make up for! We believe that the positives will evolve and the valuation is still low enough to allow for further good gains.

Chart 4: Japan’s Nikkei 225 Close to the Top of the Mountain

Source: Bloomberg

Many commentators, us included, made mention of geopolitics as an important factor affecting market sentiments in 2024. Last week had geopolitics in abundance:

1.Former president Trump was in more legal trouble with a massive fine in New York. He is now pressing the Supreme Court to hear his challenge to his loss of the case in respect of his claim for immunity from prosecution.

2. The suspicious death of Alexei Navalny has upped the risks of further sanctions on Russia.

3. The loss of a major city by Ukraine forces increases the risk that Europe has to face off to President Putin more substantially, potentially with the diminished support of the US.

4. Former Indonesian defence minister Prabowo Subianto looks likely to be the next president of the country. Unfortunately, his party failed to do as well, ending up at the third spot in the polls. Hence the country of 300m people is likely to have a coalition government that may be as initially fraught as the previous government.

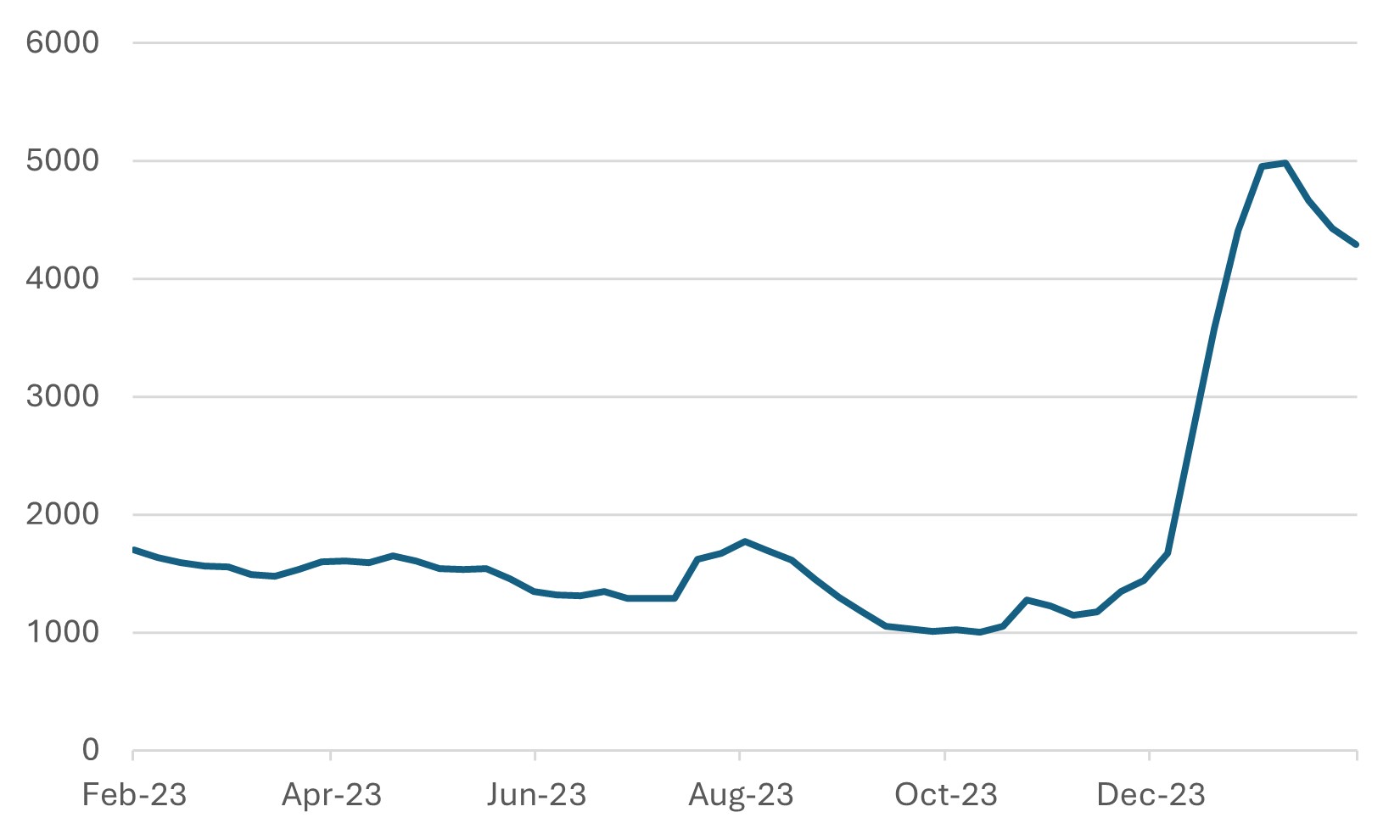

5. Houthi attacks on Red Sea continued with another ship hit by a missile, however, total attacks have declined, allowing for some reduction in the risk premium on freight rates (Chart 5).

Chart 5: Rotterdam to Beijing Freight Rates per 40m Box

Source: Bloomberg