Nothing has Changed but Everything has Changed

- Market Insights

- Financial Insights

- From the exuberance of 2023 the markets transition to 2024 has been patchy

- Over the past two years asset markets have moved sideward and market has started the year with some nervousness

- Flat earnings and higher interest rates do not bode well for the US equity market’s relative performance

- Global growth is starting the year on a mixed note while China still has its issues

- Watch out for inflation it may have regained some momentum

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The transition from 2023 to 2024 has been characterised by a stark contrast: While investors appeared in high spirits and fully confident at the close of 2023, 2024 so far has seen them take a more cautious and subdued outlook of the future. This was evident last week as equities declined 1-4% while yields on longer-dated bond surged 10-15bps. This shift, despite no significant changes in market fundamentals, suggests a growing acknowledgement on part of investors that the market rally in the last quarter of 2023 was perhaps excessive.

We looked at 2023 to understand 2024

As we reviewed the performance of asset markets in 2023, we thought it would be prudent to look at 2023 in the context of the trend seen over the past two years. So, what inferences did we draw? We believe equities have basically stood still over the past two years. This essentially dull performance during this period vis-à-vis the two years of relatively okay global growth challenges one to wonder as to why shouldn’t one get excited about the outlook for equities then. But the indifferent start to the year is a clue to our view that there are some structural challenges to the markets that could crimp potential returns particularly from US equities.

It could be that the flatter trend line for equity markets returns over the past two years is a better indicator of how the markets are likely to behave in 2024. While we do not out rightly suggest that equities will lack any sheen this year, our advice to investors is that they should expect much more modest returns than what we saw in 2023.

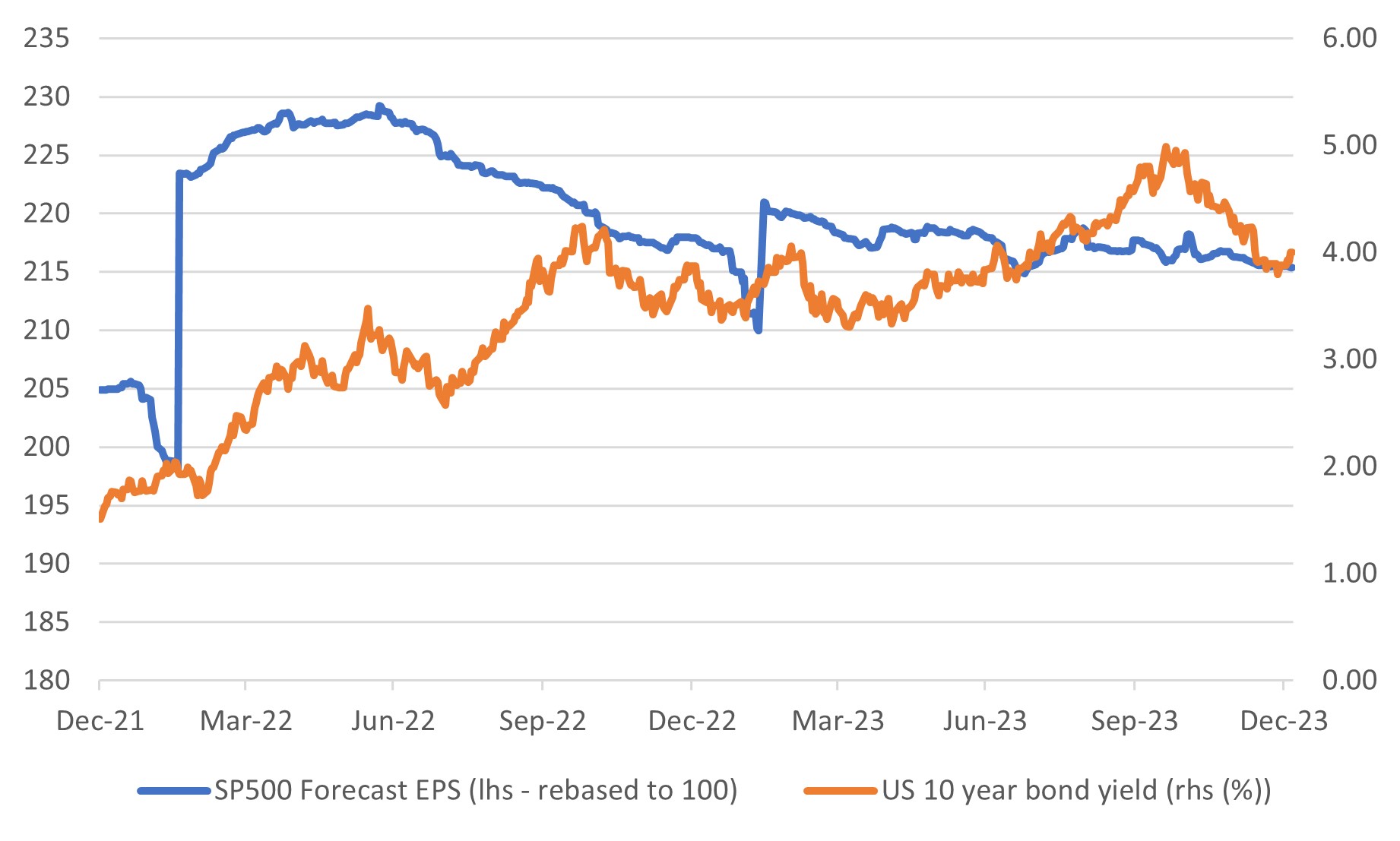

The US equity market is facing headwinds when it comes to valuation and it will likely reflect in future performance. Two key components shape the valuation of an equity market: the earnings outlook and the discount rate, i.e., interest rates. Firstly, earnings forecasts for the S&P 500 have fallen over the past two years. If we take out the noise generally associated with the first quarter of a year, given companies report earnings for the previous year, the earnings forecasts for the S&P500 have fallen to an index level of 215 from 224.

The other component, the discount rate, is well represented by the yield on 10-year government bonds. This rate has increased significantly, moving to 4.0% from 1.5% over two years. Such a rise in the discount rate typically signals a less favourable environment for the equity market, impacting valuations negatively.

Chart 1: S&P500 index earnings forecast falls over two years and the discount rate markedly higher

Source: Bloomberg

Dual challenges for the market

Today the S&P500’s forward P/E multiple is at around the same level where it was at the start of 2022. However, the two key factors discussed above for assessing the fair value of the market are faring worse than they did at the end of Q1 2022. Forward earnings are down about 5% and the discount rate is up 250bps. This dual challenge of subdued earnings forecasts and rising discount rates presents headwinds for the US equity market, suggesting investors should take a more cautious approach to equity investment in the current economic climate.

Investors may find that the economic data going forward does not match the excitement of the Q4 disinflationary, good growth environment seen particularly in the US. Last week’s global data, for example, showed reasons to remain optimistic that global growth will be around potential. Still, future inflation trends and the robustness of the US labour markets suggest limited support to the assumption that dollar interest rates would ease early.

Early last week, the Fed minutes appeared to ascribe a much more hawkish tone to the central bank’s views on future interest rate changes than the markets priced at the end of 2023. Indeed, over the weekend, Federal Reserve Bank of Dallas President Lorie Logan suggested that the Fed may have to resume raising short-term policy rates if it believes that the drop in long-term interest rates is easing monetary conditions too much.

There was a big build-up of interest in the US employment data and albeit it came in stronger than expected, it was slightly offset by weaker data from other surveys. Non-Farm payrolls were stronger than expected although a downgrade to the previous month’s data offset some of the strength. Wage growth remains close to 4%. Also, there was a very curious ISM services sector survey that showed a dramatic fall in the employment survey to a lowly 43.0 against expectations of 50.7. To date no one can really provide a good reason for the weak data point.

At a global level early economic data flow suggests that the global economy will be at or around potential through the turn of the year. There has been some good news from quarters that had been underperforming – European industrial confidence was revised higher for December keeping the level at around November’s (good) level and suggesting better momentum than was previously thought. Unfortunately for the markets, the inflation data remains mixed and doesn’t really provide the ECB with an early reason to cut policy rates.

Disappointingly, China’s economic data flow continues to show weakness that mostly results from the domestic economy. Data from other Asian regions shows ongoing growth in the tech industry. New orders for Korea, Vietnam, and China, for instance, were stronger than expected. Economists are keeping an eye on Japan where the major disruptions caused by a powerful earthquake on New Year’s Day are affecting the broader economy.

Inflation on course to edge higher?

The first quarter of 2024 could be quite challenging for those hoping to see inflation will ease remarkably further. Some of the previous factors that helped trim inflationary pressures have begun to go into reverse. Events in the Middle East, for instance, are creating challenging conditions for the movement of goods. As more and more shipping companies try to avoid the Red Sea, it is leading to higher shipping costs and delaying deliveries. The low water levels in the Panama Canal have restricted shipping, adding to the industry’s woes.

Markets will be glued to US inflation data this week, with headline inflation expected to rise 10bps but core inflation to fall a touch to 3.8%.

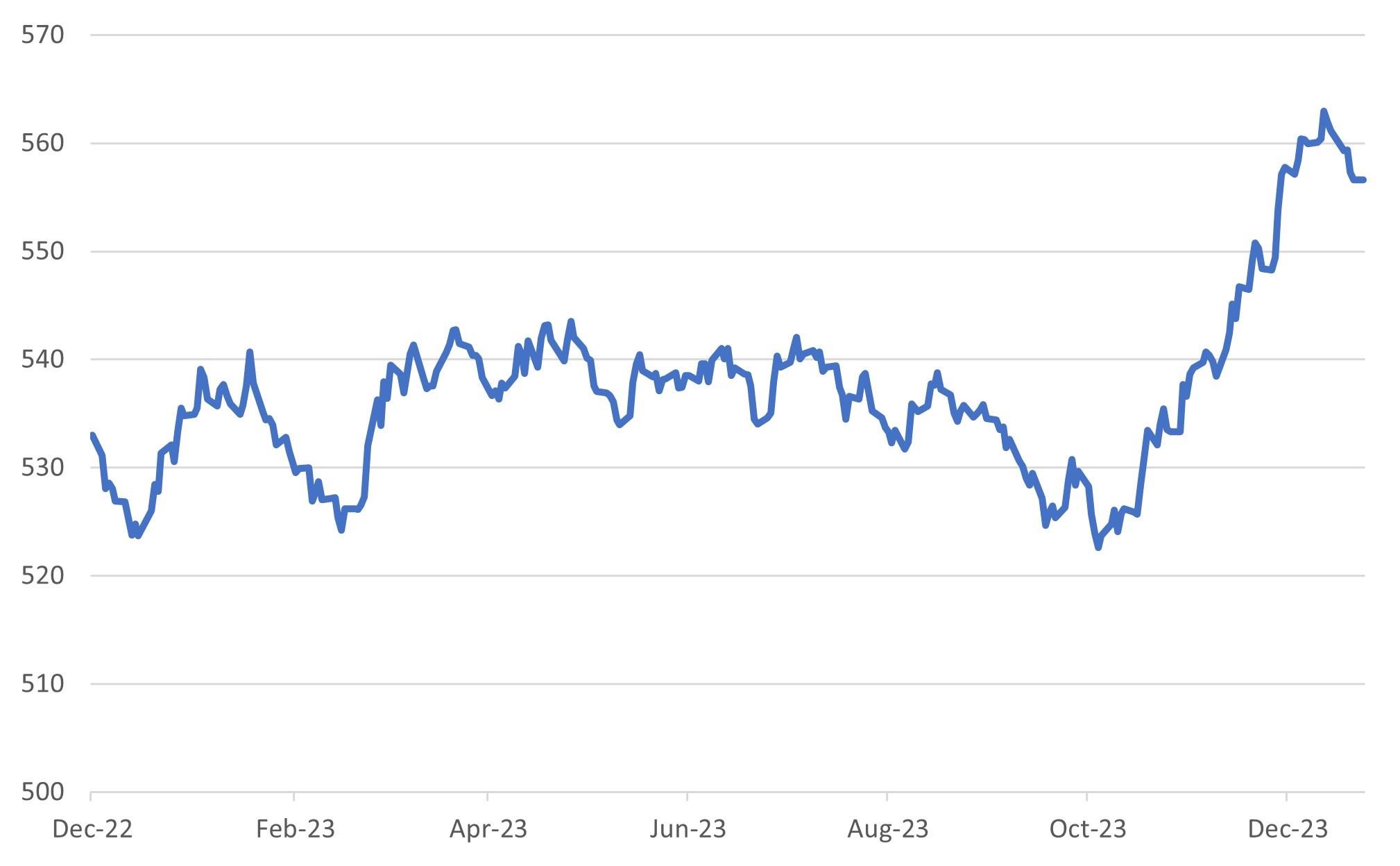

Chart 2: Global Aggregate index shows losses after strong Q4 returns

Source: Bloomberg