2023 Asset Market Review

- Financial Insights

- Market Insights

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

2023 in the context of 2022

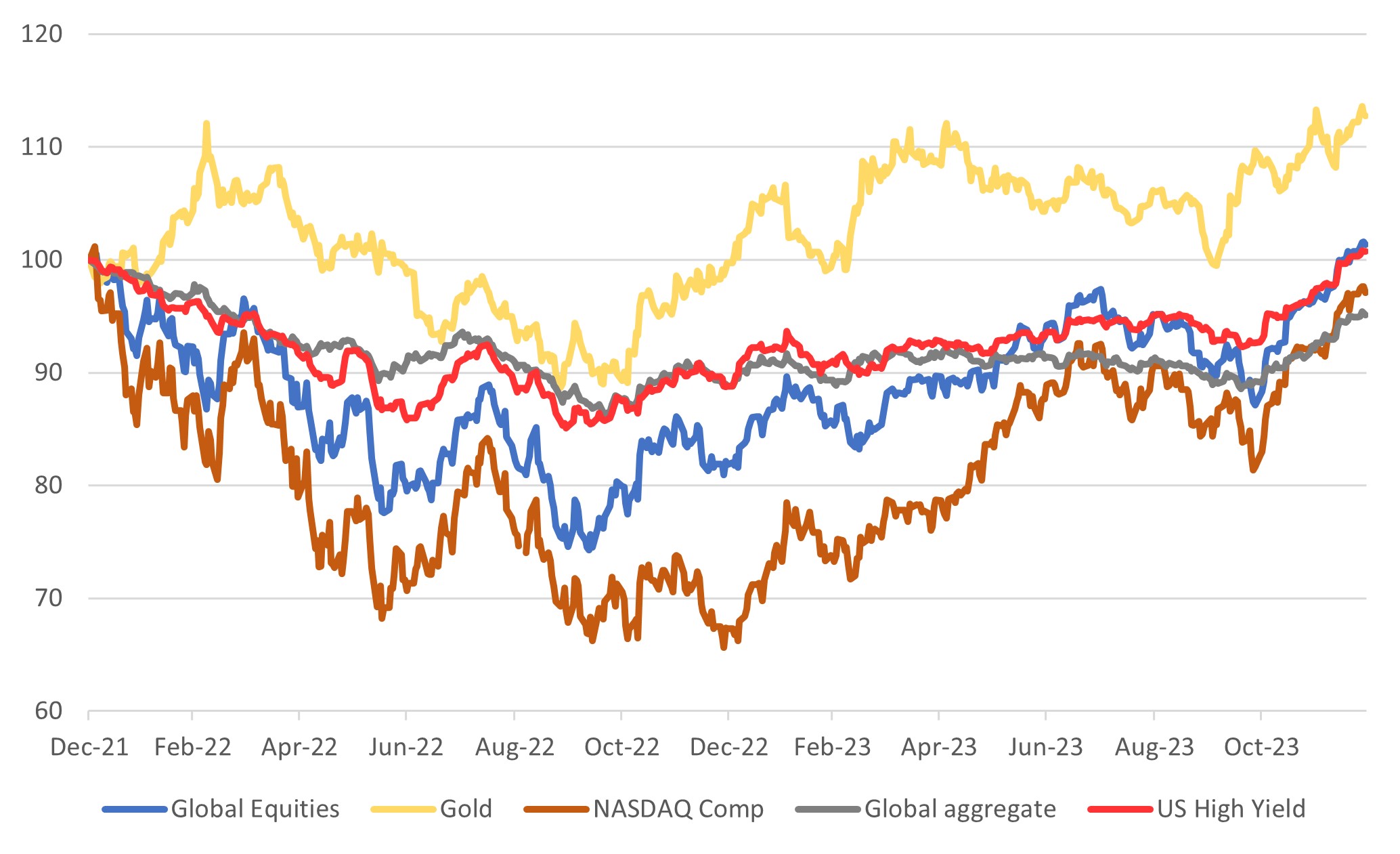

It’s shocking but true that the global equity market return (in USD) has hardly provided a positive total return in the past two years, and the NASDAQ index even gave a negative return.

It’s important to keep this in mind when reflecting on 2023, as it’s easy to get carried away with the performance of asset markets over the last 12 months and perceive it as a resounding success with potential for future success. However, when considering the substantial fall in markets in 2022, 2023 was merely a rebound from the lows.

Chart 1: 2023 asset price recovery masks a very poor 2022

Source: Bloomberg

Gold was the clear winning asset class up 12.7%. Cash returned 7.0% over the two years. The global aggregate bond total return index was down over 4% for the full two years, just marginally underperforming NASDAQ composite index!

2023 Review by Asset Class

Equities

Equities had a strong year, although half of the returns were concentrated in the year’s final two months. The pivot from the Fed from abject hawkishness to a market view that the Fed was open to the idea that they were open to cutting policy rates in early 2024 had the markets rallying hard.

As the US 10-year bond yield tumbled from a peak of 5% in November, the NASDAQ index only added to its strong performance for the year. The performance of value sectors and the better-valued European equity markets all benefitted from the easier monetary conditions with European equities outperforming the US equity market in dollar terms in the year’s final quarter.

The returns from Asian equity markets were disappointing. The heavy weight of the poor performance of the Chinese economy and its equity market limited the gains in Asian markets. The constant outlier to the difficult Asian story has been the excellent performance of the Indian equity market. A surprisingly good showing by Prime Minister Modi’s BJP party in state elections at the end of the year led Indian equities to a solid showing in the year’s final month.

Equity Market (TR)

Source: Bloomberg

By sector the IT sector was the clear outperformer of the year making up for the single digit returns from energy, consumer staples and healthcare. Consumer discretionary had a good year rebounding from the weakness of 2022 when high interest rates pressured consumer spending. The energy sector after a good mid-year when the sector rose 17% between the end of May and the middle of September weakened into the end of the year with oil prices.

Source: Bloomberg

Bond markets

Bond markets made most of their good returns in the year’s final three months. The Fed’s signal to the markets that it was open to cutting rates in 2024 spurred a significant rebound in all bond markets. The US 10-year government bond yield peaked at 5% in November before ending the year at 3.88%. The US corporate high yield index performed more consistently throughout the year as the asset class benefitted from an ongoing solid performance from the US economy, diminishing the risk of exaggerated levels of defaults. US high-yield default rates have risen to around 4% from 1% in 2022. However, default rates are far from previous peaks of 8-15%.

Source: Bloomberg

Currency Markets

In currency markets the year was marked by the poor performance of the dollar as the year closed. Much of the year had seen debate about whether there would be ground for more marked weakness from the dollar. A rising fiscal deficit, a significant rise in the indebtedness of the US, together with net selling of Treasuries by Japanese and Chinese investors had the market concerned. However, marked weakness of the dollar only occurred when the Fed signalled it might cut interest rates earlier than previously thought. Gold as a store of value was the standout ‘currency’ up 13.1% for the year, emphasising it value as a foil to any weakness in the dollar.

Source: Bloomberg