A Quarterly Turning Point

- Financial Insights

- Market Insights

- Bonds and equities give negative returns for the quarter

- The sharp rise in long term interest rates weighs heavily on the markets

- Much higher oil prices propels more inflation and the equity oil sector

- High yield bonds look vulnerable to a correction – EM debt less so

- Japanese growth still good but weak Yen worries foreign investors

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The third quarter saw almost all asset classes end in the red. While global growth has remained robust, neither equities nor bonds could make any headway during the quarter as markets remained worried about central bank policies and the persistence of inflation. We do not expect the scenario to improve anytime soon. As investors start to peer into 2024, they may not like the cocktail of slower growth, persistent inflation, and high interest rates that has now become the norm, but one that would leave a bitter taste and likely lead to further losses in the markets.

Central bankers have been reluctant in acknowledging the writing on the wall, but as they have gradually shifted their stance to align with the realities, it has spooked investors. Fears that tighter monetary conditions will persist well into 2024 have further added to the markets’ worries.

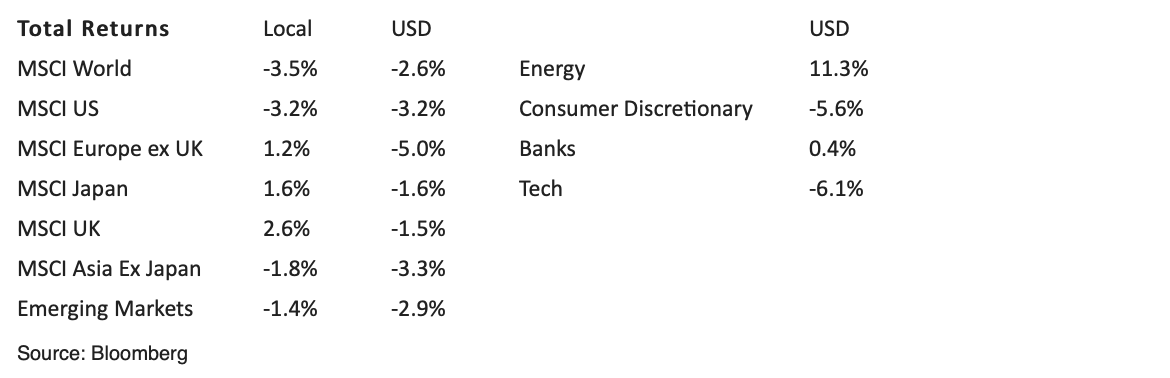

For the third quarter, all major equity markets delivered negative returns in dollar terms. Oil and the oil equity sector were the best performers, driven by the 25% surge in prices during the quarter. The energy sector showed its diversification benefit to portfolios by registering a total return of 11.3%.

Table 1: Third quarter Equity market returns (%TR)

As we head into a new quarter, the key question facing the markets is: where do we turn to for absolute returns in equity markets? In our view, markets with their own internal growth dynamic such as India and Japan could provide investors some comfort. The outlier is China where hopes of a more substantial economic recovery have gained some traction driven by the slew of better-than-expected economic data points in recent weeks.

Chart 1: China economic surprise index turns more positive – a great hope for the asset markets

‘Fixed’ worries

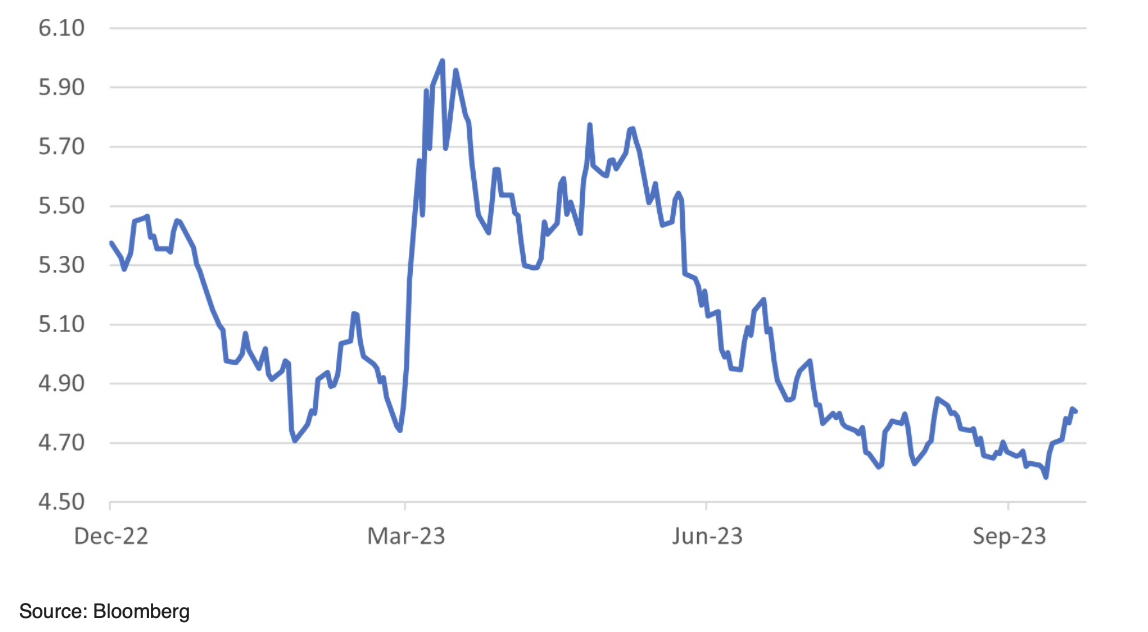

The price action in September more or less characterised the performance of fixed income markets for the third quarter. The global aggregate index fell 1.8% during the quarter, driven by a more significant 2.9% drop in September alone. Of all the sub asset classes of fixed income, only US high yield and EM debt managed to generate positive returns for the quarter.

The US 10-year bond yield rose 73bps on the quarter to its highest since October 2007. It is going to very difficult to see the Federal Reserve put the 10-year yield back in the box unless it is called on to institute another round of quantitative easing. One gets the sense that bond yields are normalising after years of manipulation. The US is finally having pay for the surprise on inflation and the long-running profligacy of fiscal policy. A 2023 fiscal deficit of 6.9% of GDP has finally come with some consequences in the bond market.

Table 2: Third-quarter Bond market returns (%)

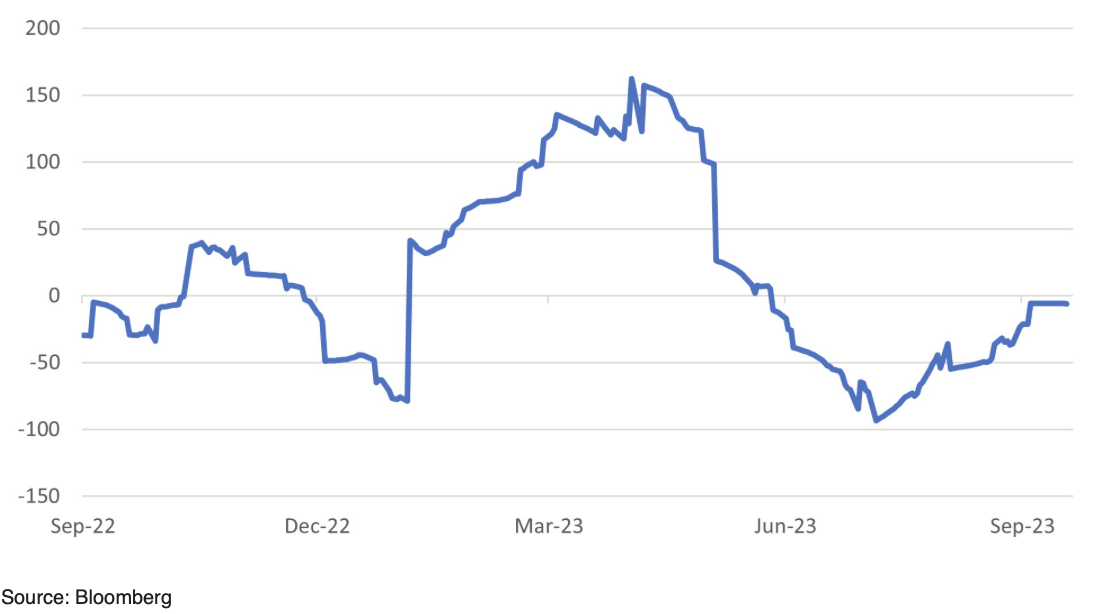

There are fears that the credit markets will experience a tough time in the coming quarters. High yield in particular looks vulnerable to downside risks. The positive return of 0.5% over the quarter belies some spread widening seen in recent weeks. Spreads have widened 20bps in the last couple of weeks but remain substantially below the levels attained earlier this year when investors were more fearful of a global recession risk. A move back to the levels seen in 2022 would add around 200bps of spread and could lead to potential capital losses of 6-8%.

Chart 2: Global high yield spreads (bps)

We are more confident with the outlook for emerging market debt. Although a stronger dollar is providing something of a headwind, we believe there is some risk of profit taking on the dollar in coming weeks. Emerging economies such as those in Latin America have greater scope to cut rates and have been reducing policy rates earlier than most. Uruguay, Brazil, Paraguay, Costa Rica, and Chile have all cut rates this year. We could therefore be closer to the peak in rates.

There were a couple of takeaways from last week’s economic data.

US economic data is a shade weaker but not signalling the kind of collapse that some had feared. Durables good orders were stronger than expected and various surveys of consumer and industrial confidence show sentiment has not withered.

The Japanese economy is unspectacular but solid and, dare I say, consistent. Retail sales and industrial production were better than expected and inflation was in line with expectations. The problem for investors is that good equity returns are being offset by a weaker yen. While the minutes of the Bank of Japan’s last meeting showed there were some dissenting voices on when the BoJ should tighten policy, many believe the central bank is unlikely to do anything anytime soon. The yen meanwhile is pushing on towards what was expected to be a symbolically sensitive level of 150 versus the dollar. A round of early intervention from the central bank would be helpful in encouraging international investors to continue to commit further funds to the equity market. Data last week showed foreign investors were heavy sellers of Japanese equities, dumping Y3.03 trillion of stocks after selling Y1.58 trillion the previous week.

The recent re-acceleration in Spanish inflation is a salutary lesson in how inflation just cannot be wished away. While it was previously held up as a good example of how underlying inflation was not that bad, as the headline inflation of 2.4% contrasted with Germany’s 6.1%, Spanish inflation unfortunately is now starting to display the same persistence as others. Data last week showed that headline inflation surged to 3.2% from 2.4%. The central bank believes that headline inflation could shoot up to as high as 4.3% in 2024. The ECB may indeed have more work to do.