Policy Makers Still Hard at Work

- Financial Insights

- Market Insights

- Fed to leave rates unchanged, but signaling is evident that its job is not done

- ECB raises rates by 25bps and signals rates to stay high for some time

- Government bond yields pushing higher – oil prices a risk

- China gives us some good news but foreign investors show little appetite to invest

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The Federal Reserve is unlikely to announce a further rate increase at its Wednesday meeting. However, the release of a fresh round of economic projections from the central bank will shape the mood of the market. We expect the Fed to signal that a further rate hike in the near future cannot be ruled out. Inflation is still well above target, and economic data has suggested that the economy, unlike projections, is in a mini cycle of re-acceleration (Exhibit 1).

Chart 1: US Economic Growth Potentially Re-accelerating

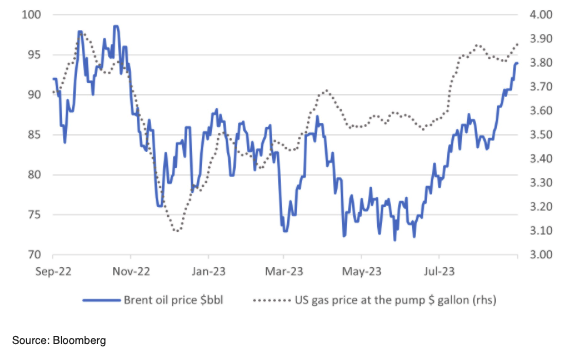

While some rather exuberant market commentators tried to interpret the strength in recent economic data as suggesting that US inflation was losing momentum, the truth remains far from it. As we have suggested repeatedly in recent months, there are significant upside risks to the oil price – and inflation – given the supply constraints and ongoing robust demand. After declining by an annualised 12% rate in the six months to May, global energy prices surged 14% in the three months to August, and there has been no letup in the upward move in prices so far (Exhibit 2).

Chart 2: Oil Price and US Gas Price up Sharply in Last Few Weeks

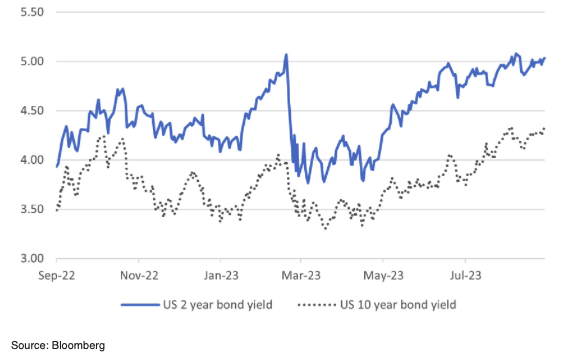

US government bond yields continue to move higher, with the 10-year bond yield reclaiming its one-year high of 4.33%. The introduction of the Fed forecasts for 2026 that are likely to show the Fed reaching their 2% inflation forecast might just help arrest the short-term increase in yields.

Chart 3: US 2-year and 10-year Government Bond Yields to Hit Short-Term Peak

Meanwhile, on 14 September, the ECB announced a further 25bps rate hike, even though parts of the eurozone economy, such as Germany, remain weak. While the ECB signalled that the rates would remain higher for longer, the market drew comfort from the message that the central bank sent out – the rate hike was in all likelihood the final in this cycle.

The persistence of inflation has kept government bond markets on the backfoot. Credit remains the ongoing winner, with high-yield bonds leading the pack (global high yield +6.5% YTD). However, we expect bond markets in general to struggle in the coming quarter as they contend with the safety of 5.0-5.5% cash yields. Nevertheless, we would remind investors that cash is a one-dimensional asset, and switching the entire bond portfolio into cash is never warranted, certainly with a more medium-term view. Central bankers are fixated on bringing inflation down, even if it means pushing their respective economies into recession. To the ears of bond investors, recession risk is good news as it will likely lead to lower yields and capital gains for investors in government bonds.

China – some relief but larger worries

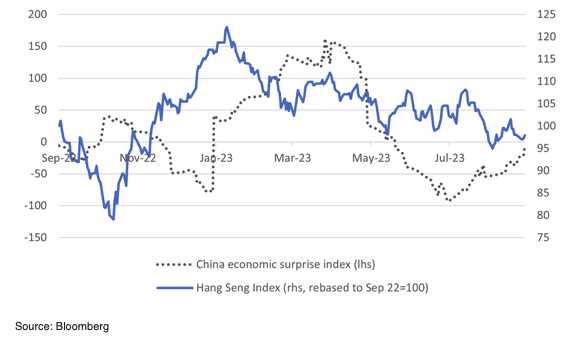

There was some good news from the Chinese economy last week, with a few better-than-expected economic data points helping boost hopes of a revival in sentiments. For August, retail sales (+4.6% year-on-year) and industrial production (+4.5% year-on-year) were well ahead of market expectations. Overall, Chhina’s factory output is up at an annualised 25% rate over the three months to the end of August. Fixed asset investment of 3.2%, which is down from 3.4% for the first eight months of the year, was the only disappointing data point released last week.

Nevertheless, the improvement comes after a raft of measures announced through July and August to support the economy. Although many of these actions have been incremental in nature, a total of 44 separate measures over the past few months have certainly given the economy a sufficient nudge to put growth back on track to the aspirational 5% GDP growth level for the third quarter. On Thursday, the People’s Bank of China (PBOC) provided a fresh monetary stimulus by reducing the reserve requirement ratio by 25 basis points – a measure that effectively injects 500 billion yuan ($68.7bn) of new liquidity into the system. The extra liquidity will provide some support for capital investment.

Despite the better news from China, Chinese equities drifted lower over the week after an initial knee-jerk recovery. In Hong Kong, the Hang Seng index has not shown any marked strength despite the improving economic data trends and remains 20% off its post-COVID high of January 2023. We suspect that foreign investors remain increasingly worried about the structural concerns plaguing the economy, namely the challenges in the property sector and fears of potentially less market-friendly policies from the current leadership. It was noticeable that Alibaba and JD.com, the two stocks that overseas investors have preferred previously, were down on the week. It is clear that unless an influx of domestic money happens, the market will remain depressed.

Chart 4: Improving Chinese Economic Data Has Failed to Push Hang Seng Index Higher

For international investors looking to buy into the Chinese recovery without buying Chinese equities, luxury goods companies (Exhibit 5) and commodity stocks are the best proxies for a recovery in Chinese demand. The only caveat on the commodity front is that the ongoing autoworkers’ strike in the US, which, if it gains momentum, could hit metal prices. This is the first time the Union of Auto Workers (UAW) has announced a strike against all the three major automakers simultaneously. The unions are asking for a 40% pay increase, with an initial 20% to be paid this year and the balance over the subsequent three-and-a-half years.

Chart 5: GS EU Luxury Goods Sector Index